Published: Updated:

How did a $428 Southwest Airlines ticket end up costing an American Airlines customer in distress $4,500? If you guessed a fake airline call center scam is behind this astounding upsell, you would be right.

After missing his flight to Puerto Vallarta, Ethan Permaul became the latest victim tricked into calling a fake airline customer support number. In a panic, Permaul dialed what he thought was American Airlines hoping an agent could quickly rebook him. Instead, he reached a scam call center.

There, a friendly (but fake) “AA agent” told him a convoluted tale that ended with a replacement flight on Southwest Airlines. That ticket came at the sky-high cost of $4,500, which would soon be refunded, according to the fraudster.

The scammer told Permaul that the ridiculous figure pending on his credit card was just a “procedural” fee. He said the airline would refund the entire $4,500 by the next billing cycle. That sounded fine to Permaul, who was just relieved that his tropical plans were back on track.

He boarded his Southwest flight to Mexico and assumed the refund would soon arrive.

But it never did.

And when Permaul filed a credit card dispute to fight the fraudulent charge, the scammer fought back. That con artist provided proof to Chase that Permaul agreed to the nonrefundable terms of the Southwest Airlines ticket — and that he took the flight.

Four months later, with the giant fee still firmly lodged on his credit card bill, Permaul contacted Consumer Rescue. He hoped that we could convince Chase he was the victim of the increasingly common fake airline customer support scam.

Can we do it and claw back his $4,500 from the unscrupulous hands of a scam call center?

“Someone at the airline counter gave me the scam phone number.”

Last spring, Permaul’s grandmother gifted him with a round-trip flight from Atlanta to Puerto Vallarta. She redeemed American Airlines miles for her grandson’s trip.

On the day Permaul was scheduled to fly to Mexico, he didn’t make it to the airport in time. Missing the flight set off a series of unfortunate events for him.

“I missed the flight,” Permaul told me. “I’m not sure how I got the number I called. But I think someone at the AA ticket counter gave it to me [the scam call center number].”

Where Permaul got the number from is not clear. But what is crystal clear is that the number he called wasn’t associated with any airline. Dialing the number put him in immediate touch with a scammer. That was a predator who was intent on extracting big bucks from his target.

The language of scammers: gobbledygook

The man who answered Permaul’s call launched into a spiel that could only be described as gobbledygook.

“He told me that because my ticket was booked using frequent flyer miles, there were some procedural fees,” Permaul recalled. “But he said there was good news. He could put me on a Southwest Airlines flight for free since he said it wasn’t my fault I missed my original flight.”

Next, the “agent” informed Permaul that he just needed his credit card to charge those “procedural” fees. He assured his unsuspecting victim that those fees would be refunded. In fact, he would receive notification of the refund that very day.

What Permaul was hearing should have set off all sorts of warning signals. But it didn’t. That’s because he was laser-focused on getting his trip back on track. So he continued to miss the red flags popping up at every turn during the call.

“I gave him my credit card and my email address,” Permaul explained. “He gave me a record locator for my new Southwest flight and then we hung up.”

Fact: Scam customer service never refunds your airline fees

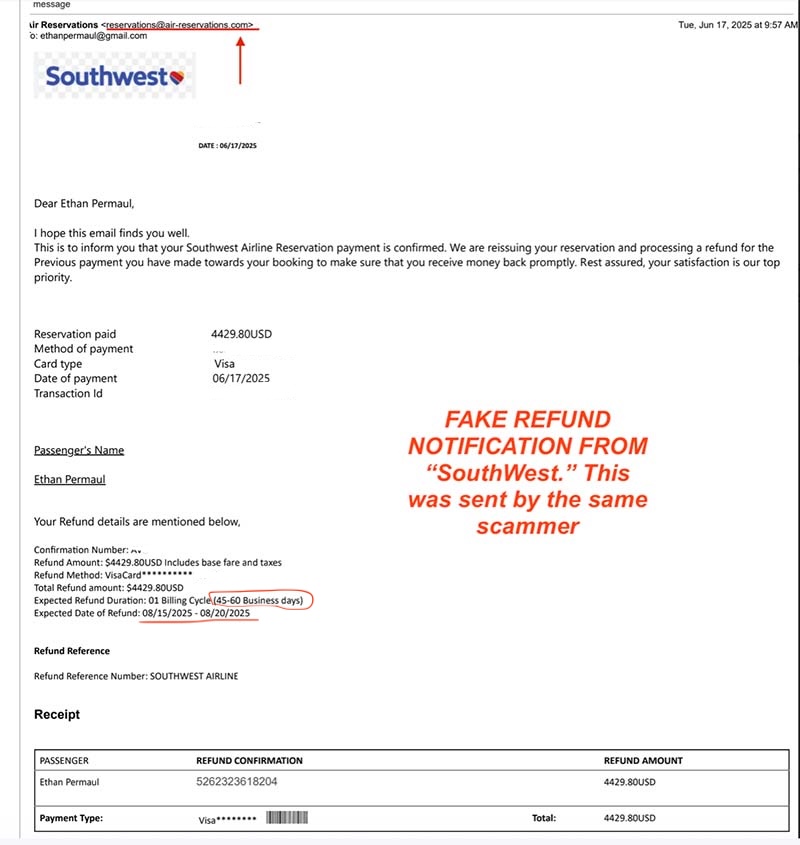

Sure enough, in a little while, Permaul received an email seemingly from Southwest Airlines. The message confirmed that $4,429 had just been charged to his Chase Sapphire card. The notification went on to say that a refund in the same amount was in process.

Of course, it wasn’t and never would be.

The refund notification sent by this scammer was meant to throw Permaul off his tracks. Credit card companies expect their customers to report fraudulent charges ASAP. So the longer a bad actor can keep a customer from becoming aware of their misdeeds, the better chance they have of winning a credit card dispute.

And that’s what happened here.

Permaul went to Mexico and enjoyed his trip. He waited patiently for the $4,429 refund that “fake Southwest Airlines” said would arrive between August 15 and August 20.

When those dates passed with no sign of that refund, he began to get impatient. Permaul called the same number as before to find out what the hold up was. Amazingly, seemingly sure he had a sucker on the hook, this scammer decided to double down.

Suddenly seeing all the red flags of a scam call center

“He [the scammer] told me that there was a glitch that had prevented my refund from being processed,” Permaul told me. “He said we just needed to process a $2,000 ‘dummy charge’ and then it would all be refunded.”

A dummy charge, indeed.

With that request for an additional $2,000, Permaul was suddenly jolted into reality. All the red flags that he had missed previously suddenly glared brightly in front of him.

“I want my money back. You’re a scammer,” Permaul told the man. “Give back everything you stole from me.”

Unintimidated, but understanding the gig was up, the con artist just laughed and hung up.

Permaul’s next call was to Chase’s fraud department to report the jumbo charge as a scam.

📬 Subscribe to:

Tales from Consumer Advocacy Land

Real stories. Real rescues. Real advice.

Join thousands of smart travelers and savvy consumers who already subscribe to Tales from Consumer Advocacy Land — the friendly weekly newsletter from Michelle Couch-Friedman, founder of Consumer Rescue. It's filled with helpful consumer guidance, insider tips, and links to all of our latest articles.

If a scam call center actually books you a ticket your credit card dispute could be doomed

Not all fake airline customer service centers are created equal.

Related: Scam customer service centers are all over the Internet. Here’s what to know

Some are outright criminal operations and don’t do anything except take your call, charge your card and steal your money. Credit card disputes against fraudsters are typically easy to win since the consumer has received nothing from the scammers.

But other scam call centers actually book a ticket for their victim, tacking on an astronomical service fee at the end. These bad actors frequently fight credit card chargebacks using the ticket confirmation as supposed proof of what they did to deserve their fee. Faced with evidence that the “merchant” did provide a service, credit card companies often find in favor of the scammers.

Related: Help! Fake United Airlines customers support charged me $1,700 service fee

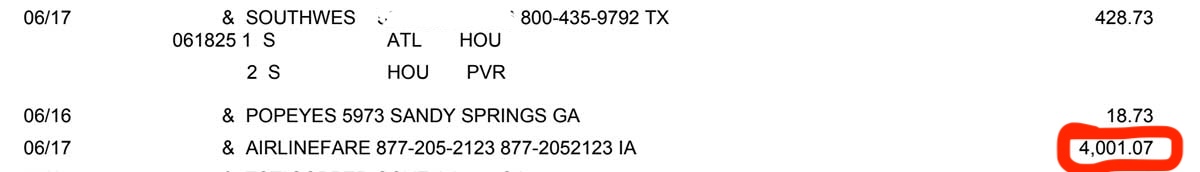

In Permaul’s case, he did receive a Southwest airline ticket. He did take the flight. Of course, that ticket according to the actual charge from Southwest was just $428. The $4,001 service fee the scammer took for himself was nearly ten times the amount of the airline ticket.

This was all clearly a scam. But…

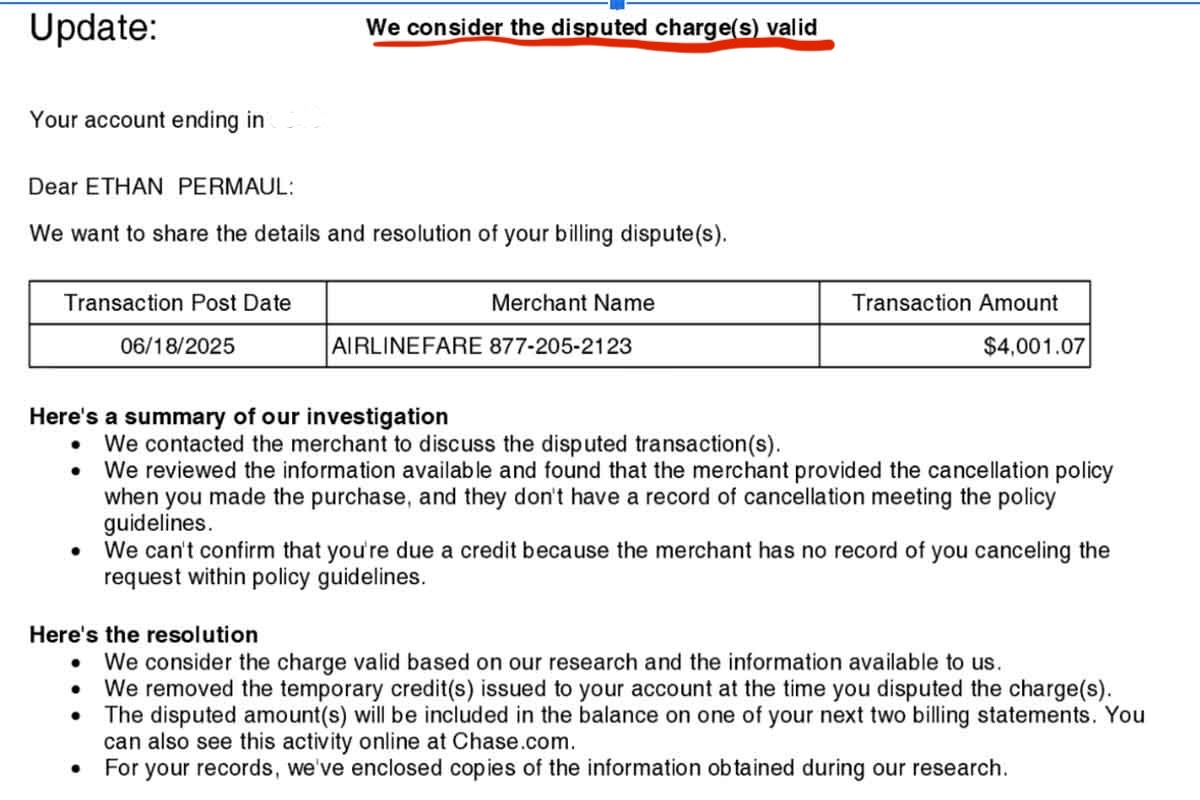

A lost credit card dispute against a scammer called “AirlineFare”

As I’ve pointed out before, credit card disputes are not in-depth investigations like you see here at Consumer Rescue.

If a merchant responds and challenges a chargeback with any kind of evidence, the consumer generally loses. These aren’t criminal investigations, so without any real evidence of outright fraud, it’s difficult for a victim of a fake airline call center to win a dispute.

And Permaul didn’t.

Permaul was shocked to learn that he’d lost his credit card dispute after the fake airline agent fought back. That happened after the bold scammer provided proof to Chase that he’d booked the Southwest Airlines ticket for his “customer.”

Asking Consumer Rescue to prove a scammer is behind the charge

In October, Permaul had exhausted all his options and it looked like the scammer was going to emerge as the victor in this $4,000 battle.

When he confided in his grandmother what the scammer had done, his grandmother had some advice for her grandson.

“My grandmother told me to send a request for help to Consumer Rescue,” Permaul told me. “I don’t have anywhere else to go now. I’m desperate. Can you help?”

I sure hoped I could. I’ve handled a lot of complaints from passengers who accidentally dialed up a scammer instead of reaching the airline they were trying to call. But this bad actor was particularly cocky and brazen and had stolen thousands of dollars from Permaul. He’d even challenged the credit card dispute, presenting himself as an actual merchant when he really is just a common thief.

It was time to present Permaul’s case to our always helpful executive team at Chase.

Resolving problems for Chase customers

Recently, I tackled a shocking story over at The Points Guy of a vegetarian couple who had traveled to Argentina. On the last night of their trip, they stopped for a bit to eat at a traditional parrilla (Argentinian grill).

After arriving home the next day, they discovered a $29,000 bill on their Chase credit card. The restaurant had charged the duo for all the meat deliveries for the week. The couple struggled for six months to have the billing error corrected until I received their request for help.

I tell you this because sometimes consumers find it impossible to reach the right people inside a company who can correct a problem. That’s true, even if all the facts are on the customer’s side.

It seemed that Permaul was stuck in a circular loop with no end. He continued to appeal his credit card dispute, but he was no closer to getting his money back.

Related: Cruise ship passengers tricked out of $6,000 by fake Costco Travel

Asking the Chase executive team to have a look at this $4,001 “service fee”

Here’s a partial excerpt of my email conversation with the Chase executive team, along with the “refund” notification from “fake Southwest Airlines.”

…The scammer even created a fake refund notification that on the surface looks like it came from Southwest Airlines. But it was all phony, just meant to throw Ethan off guard and make the interaction appear legitimate. Later, when the refund didn’t appear, Ethan called the scammer back who told him he needed to make a $2,000 “dummy charge” to get the refund rolling. That’s when Ethan realized it was a complete scam.

Michelle Couch-Friedman, Consumer advocate

I was convinced that Permaul’s battle would soon come to a positive end.

And I was right.

Great news: Score another for the good guys!

In a little more than a week, Permaul had his answer.

Michelle, thank you for bringing this case to our attention. Happy to share that this has been resolved and the customer should be seeing a refund on his account within the next 48 hours. Our claims team spoke to Mr. Permaul this morning to let him know the good news.

Chase Spokesperson

Permaul couldn’t be happier with the outcome.

Hi Michelle,

I am so glad to hear the news! And I can’t thank you enough for all the time, persistence, and care you’ve put into helping me get this resolved. I sincerely appreciate advocating on my behalf. This has been such a relief, and I’m very grateful for your help throughout the whole process.

Thank you again,

Ethan Permaul

You’re very welcome, Ethan. I’m pleased your money has been extracted from this arrogant scammer’s hands and back into your bank account. Right where it belongs!

Fake airline customer service scams aren’t going away. Here’s what to know

Unfortunately, Permaul’s plight is not unusual. Similar pleas for help pour into the Consumer Rescue helpline on a daily basis. In fact, right now, I’m working to find a way to retrieve thousands and thousands of dollars that have been stolen from airline passengers by these scam call centers.

However, this is no easy task because, in general, credit card companies don’t refund fees that a customer readily agrees to. When a consumer willingly hands over their credit card number to pay a fee, it is often a done deal.

That means consumers must be more careful because scam call centers aren’t going away. These fraudulent operations are only growing larger and becoming more sophisticated.

Here’s what you can do to outsmart the bad guys.

Related: Cruise passenger mistakes flood our helpline. Here’s how to avoid them

Slow Down

Every scammer depends on keeping their victim off guard — talking fast, using technical jargon, and instilling a sense of urgency. If you reach a customer service agent intent on sealing the deal quickly, consider that a red flag. Actual airline customer support representatives have no reason to urge passengers to make a decision quickly. But con artists do. The longer you’re on the line, the more chances you have to catch on to their scheme and hang up.

So even though you may be in distress after a canceled or missed flight, don’t make your situation worse by blindly dialing a number and handing over your credit card. That could be an expensive mistake that you can’t escape from, unfortunately.

Use your airline’s mobile app

The easiest way to make certain that you don’t call into a fake customer service center is by installing the official mobile app of your airline. Not only will you always have the correct number for your airline at your fingertips, but there’s plenty of additional helpful information contained in that app. Things like your gate information, boarding time, weather at your destination, a baggage tracker and maps of the airports.

These apps are free and can be your best friend should your flight become delayed or canceled. There is really no reason not to download your airline’s app to your mobile device.

Question unusual terms and hang up

If you’ve already dialed a number you believed to be your airline’s customer service center, but the conversation is becoming strange, ask questions. Never agree to a giant charge to your credit card, even if an agent tells you it will be refunded. There is no logical situation in which an airline would do that type of shenanigans. But a scammer will think up all sorts of explanations to try to keep you confused.

If something an “airline agent” tells you sounds nonsensical, you’re likely chatting with a scammer whose only goal is to steal as much money from you as possible.

The bottom line

Falling prey to fraudsters pretending to be helpful airline agents can ruin your vacation and wreck your wallet. The victims of this scam are immediately plunged into a battle to retrieve their stolen funds that can last for weeks and even months. Sadly, for some victims their money will never be recovered.

The best defense against these predators is not to fall into their trap in the first place. Because once you’re in it, there may be no way out.

Of course, Consumer Rescue is here to help — and if there’s any way out, I’ll find it. Our assistance is always friendly, fast and free of charge. (Michelle Couch-Friedman, Your Chief Fiasco Fixer 😜and founder of Consumer Rescue)