Published: Updated:

A Florida couple missed their much-anticipated Princess cruise after a flight delay caused them to miss their connection to Australia. However, that’s not the worst part of this story – not by a long shot. The real shock came when the stunned duo learned the fate of the $21,000 they spent to book the 41-day sailing aboard Crown Princess.

According to their travel insurance company, the couple would receive just $1,000 for their missed cruise.

In shock, those Princess Cruises passengers, Rudy and Ellen Tang, asked Consumer Rescue for help. They believed the cruise line’s Vacation Protection Plan should have protected them against this massive loss.

So why didn’t it, and could anything be done to recover the money the Tangs spent on their missed cruise?

That’s what I aimed to investigate.

A world adventure with Princess Cruises

Last year, the Tangs decided to go big with their next cruise. They dreamed of an epic journey packed with once-in-a-lifetime experiences. As Elite members of Princess Cruises Captain’s Circle loyalty program, they, of course, intended to travel with their favorite cruise line.

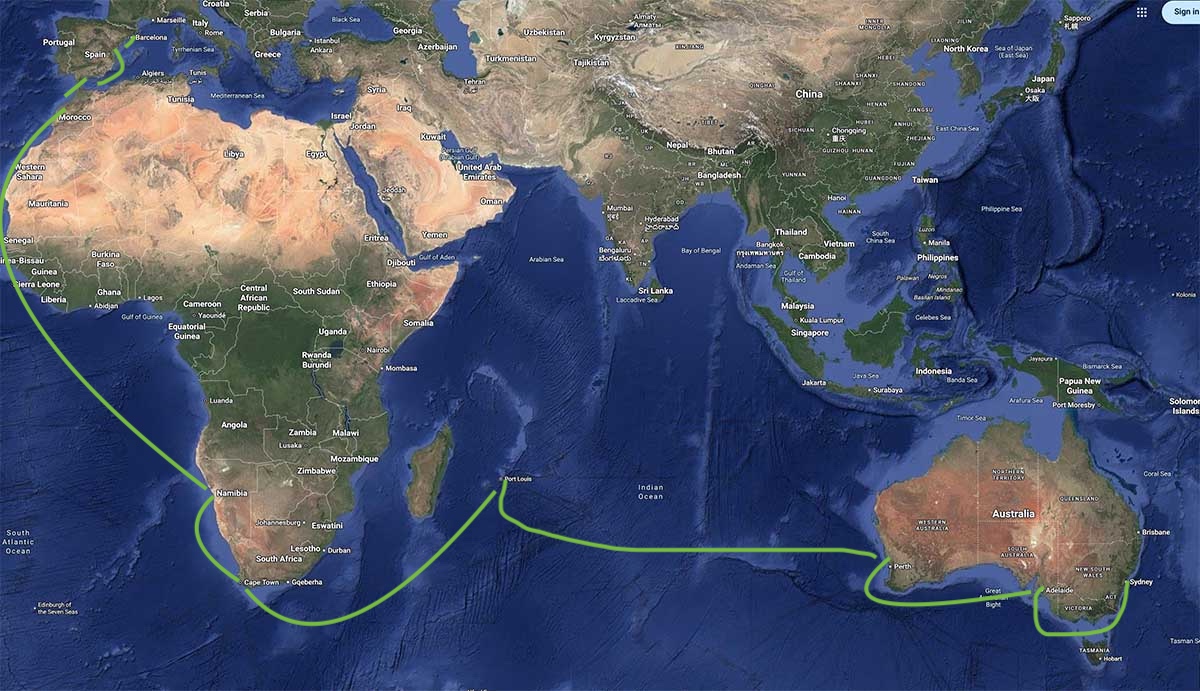

After considering all their possibilities, the couple settled on a 41-day cruise aboard the Crown Princess. The sailing would begin in Sydney, Australia, and end in Barcelona, Spain.

To join their adventure aboard the Crown Princess, the Tangs needed to fly from Miami to Sydney.

“I thought that by booking the flight through the Princess system, we would have extra security,” Tang told me. “I also bought the trip protection offered by the cruise line to tighten up that security.”

After booking the cruise, Tang used the Princess EZair online program and confirmed flights from Miami to Sydney via Los Angeles to meet the Crown Princess. Their return flight would be non-stop from Barcelona, the final stop of the cruise.

Unfortunately, Tang had chosen an unforgiving flight sequence. Even without any flight delay, it left the couple just hours to get to the cruise port in Sydney.

That was a mistake that would become devastatingly clear on the day the couple set off for Australia.

A 5-hour flight delay leads to a missed connection to Australia

Two days before the Crown Princess was scheduled to sail, the couple headed to the Miami International Airport. They weren’t expecting any problems, but Mother Nature had other ideas.

On that day, severe storms hit southern Florida, causing a ground stop for some time at MIA. By the time the couple’s flight to Los Angeles was cleared for take-off, it had been delayed for over five hours.

The window to make their international flight – and save their Princess cruise – had been reduced to just minutes. But the Tangs decided to board the flight bound for Los Angeles and hope for the best.

Unfortunately, it was not to be.

The Tangs’ flight from MIA touched down at LAX at 10:57 p.m. Their connecting flight to Sydney, American Airlines flight 73, pushed back to 11:05 p.m. — without the couple aboard.

The five-hour flight delay had caused them to miss their connection – and ultimately the cruise. They would soon discover, missing the embarkation of the Crown Princess was only the start of this expensive nightmare.

Related: We missed our Norwegian cruise ship – how do we get our $4,500 refund?

“We’re going to miss our Princess cruise!”

“A few minutes after landing, I received a text from American Airlines,” Tang explained. “We had been rebooked for the next day on the same flight, but that would have been too late.”

Realizing they would arrive in Australia after the Crown Princess had already sailed, the couple decided it wasn’t worth trying to catch up to the cruise.

“At 76 and 72, we’re too old to deal with that type of complications,” Tang told me. “American Airlines offered to fly us back to Florida at no charge.”

The fatigued couple boarded the red-eye flight back to Miami.

“We were confident we would receive all of our money back through our travel insurance claim,” Tang explained.

Unfortunately, Tang would soon learn that his expectations were overly optimistic.

Travel insurance assigns a $1,000 value to the missed cruise claim

Tang says that on the day he and his wife arrived back in Florida, he called Princess and officially canceled their cruise.

“Princess sent me a cancellation notice for the cruise at 3:31p.m.,” Tang explained. “Then an agent told me that I should file a cancellation claim through Aon, the travel insurance provider.”

So that is what Tang did.

But the claim was quickly rejected because Aon determined that the couple had begun their trip. As a result, their situation was considered a trip delay. The expectations were that they should have been able to meet up with the ship with the help of EZair.

The policy paid Tang and his wife $500 each for the first night of their missed cruise, which was the extent of their travel insurance coverage under the circumstances.

📬 Subscribe to:

Tales from Consumer Advocacy Land

Real stories. Real rescues. Real advice.

Join thousands of smart travelers and savvy consumers who already subscribe to Tales from Consumer Advocacy Land — the friendly weekly newsletter from Michelle Couch-Friedman, founder of Consumer Rescue. It's filled with helpful consumer guidance, insider tips, and links to all of our latest articles.

Tang says he was stunned by the (non)determination from Aon.

“I paid $1,255 for the Princess Platinum Vacation Protection plan,” Tang complained. “But now the joke is on me – we’re only getting $1,000 back out of $21,000!”

Fact: Princess Cruises Vacation Protection is valuable — if you understand it

The Platinum Princess Vacation Protection is a comprehensive plan that provides customers with pre-departure cancellation protection and a post-departure travel insurance policy. It is not a traditional travel insurance policy because of these two separate components.

The pre-departure cancellation protection is provided entirely by Princess Cruises. This is a non-insurance feature and doesn’t have an underwriter – the cruise line is responsible for providing the benefits.

Unfortunately, as we’ve seen in recent years with the bankruptcy of Vantage Deluxe World Travel, if a cruise line is self-funding their pre-departure vacation protection and has no money to pay those claims, the passengers are at great risk.

However, as long as a cruise line is not in any danger of going bankrupt, as I assume Princess is not, this type of “protection” can be a suitable alternative to a traditional travel insurance policy.

Related: How buying travel insurance from your tour operator can be a $20,000 mistake

Princess Cruises CFAR: Cancel For Any Reason

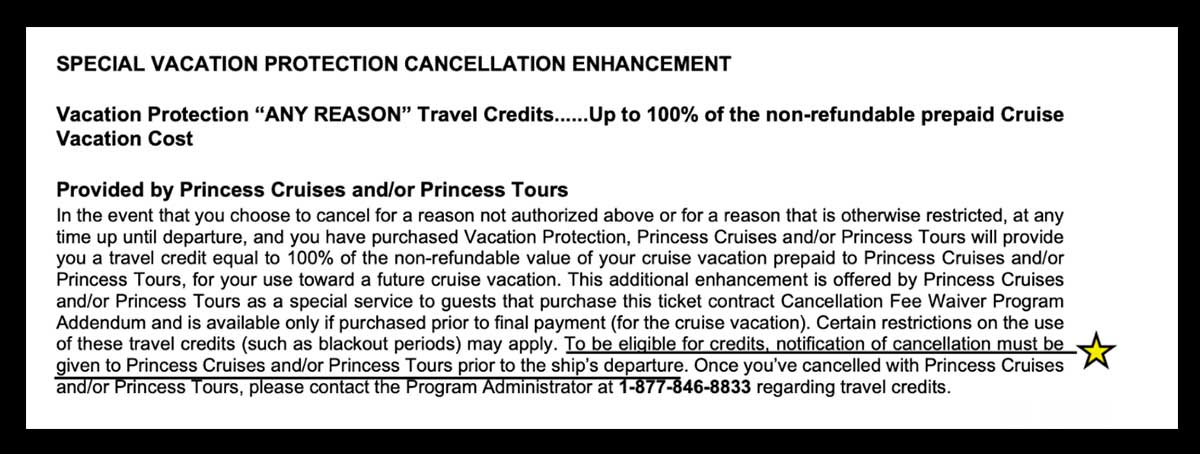

A unique aspect of Princess Cruises Vacation Protection is that passengers can cancel right up to departure for any reason and receive 75 to 100 percent of their nonrefundable cruise fare in future travel credits.

Traditional travel insurance policies include specific “named perils,” which are covered reasons for cancellations. If you have a traditional travel insurance policy and miss your cruise because of a flight delay or traffic problem, you could be out of luck.

Related: We missed our Carnival cruise. How do we get our refund?

Unfortunately for the Tangs, they were unaware of many of the benefits of their travel protection plan, including the 24-hour hotline available for “en route guidance.”

That hotline would have easily helped them through the difficult situation they found themselves in after the extended flight delay and missed connection. The couple could have been aboard the Crown Princess instead of sitting at home in Florida battling a travel insurance company.

Princess Cruises EZair Next Port Protection

Because the Tangs purchased their airfare through the Princess EZair program, they had “next port protection.”

In the event your flights are delayed or canceled by the airline on the day you are en route to or from your cruise, our staff is ready to assist you, 24/7. We’ll even take care of any flight changes if needed to join the voyage on the next available flight or to the next available port of call.

[Princess Cruises EZair Next Port Protection policy]

Had the Tangs called the 24-hour hotline from LAX, they could have been rerouted to Adelaide (the first stop of the Crown Princess) instead of returning home.

Unaware of the help available, the exhausted travelers accepted American Airlines’ offer to fly them home — and missed the Princess cruise they had dreamed about for months.

Are we really only owed $1,000 for our missed Princess cruise?

Travel insurance and travel protection are certainly confusing topics for travelers. Misunderstandings often lead travelers to surmise that travel insurance is a scam or a waste of money.

Related: 4 travel insurance mistakes that almost cost this reader $2,999 (My report for The Points Guy)

The truth is, a comprehensive travel insurance or protection policy can be a life saver to a traveler who understands what they’ve purchased and needs to use it.

However, if you don’t know much about your policy, it’s easy to see why you might determine it to be useless. Travel insurance policies are lengthy and can be tedious to read, but it’s a mistake not to spend the time to go over the document.

Related: Here’s an $11,504 travel insurance mistake you won’t want to make

When Tang reached out to me, he was desperate – and understandably so. He had been issued only $1,000 of compensation in exchange for a $21,000 cruise fare he thought he’d protected with travel insurance.

“Can you help me?” Tang lamented. “We missed our Princess cruise through no fault of our own and now we have lost $21,000. This isn’t fair.”

I agreed that it wasn’t fair, especially after I looked at the details of the Princess Platinum Vacation Protection.

Passengers should always call the cruise line before abandoning the ship

Unfortunately, Tang made some travel insurance mistakes that put his entire cruise fare in jeopardy. Because he didn’t familiarize himself with the Princess Platinum Vacation Protection before setting off on the journey, he didn’t know about the benefits available to him while he was in crisis mode.

The Tangs’ post-departure travel insurance policy only provided trip delay coverage up to $500 per person. Skipping the rest of the trip because of a missed connection is not a covered reason to cancel and receive a refund. Had Tang called the 24-hour hotline provided by the Princess Vacation Protection or EZair program, he would have learned that critical piece of information.

As a cruise passenger, you should be aware that if you have a travel protection policy, you should always contact the provider before you press the eject button. Before making a drastic decision like abandoning the entire trip, it’s crucial to confirm you’ll be covered for the cancellation.

Did time zone differences cause the couple to miss the cancellation deadline?

Because the Tangs had decided not to travel to Australia and returned home instead, the Cancel for any Reason clause should have kicked in – as long as they canceled before the Crown Princess departed.

When Tang told me that he didn’t call to cancel the cruise until the next day, I suspected he may have missed the cutoff for cancellation. After all, Sydney is 14 hours ahead of Eastern Standard Time in June.

But when I looked at Tang’s official cancellation notification from Princess, it was stamped June 3, 3:51 p.m., about eight hours before the ship sailed.

It was time to ask Princess why the Tangs had missed their cruise and lost nearly all of the money spent on it.

Asking Princess Cruises why the couple is still empty-handed

I sent the Tangs’ case over to our executive contact at Princess Cruises to find out what had gone wrong. Based on the Princess Vacation Protection plan for Elite Captain’s Circle members, the couple should have received 100 percent of their nonrefundable cruise fare as future credit.

Unless there was something I didn’t know, the cruise line had made a mistake rejecting Tang’s request.

As it turns out, Princess Cruises agreed that it owed the Tangs the hefty future cruise credit. However, in a phone call, a Princess Cruises executive explained to me that the sticky point was the airfare.

Nearly three months after the missed cruise, Princess Cruises was attempting to negotiate a refund from American Airlines for the “trip in vain” flight. I was assured that as soon as that refund was secured, the couple would be issued their full cruise credits.

After more delays — and a few nudges — Princess finally delivered the good news.

The good news: Princess Cruises grants future travel credit for the missed cruise

In the end, Princess Cruises made the Tangs almost completely whole. The couple received cash refunds for the American Airlines flights, port fees, and taxes. For the nonrefundable parts of the missed cruise, they received future travel credits.

The Tangs are now looking forward to planning a new cruise to replace the one they missed in such a dramatic way. After months of uncertainty, the couple finally had closure.

Michelle,

Rudy Tang

I really appreciate your help. In June, I was in a desperate situation. I had exhausted all my efforts, then the bookmark of Consumer Rescue hit me.

I started my journey to seek help from you and I almost lost hope when the month of August began. But your emails continued to provide me with courage and hope. Now, the unselfish services provided by you have come to its fruits, I must say that you are a champion in my mind!

Thanks x 1000 !

You’re very welcome, Rudy! This is exactly why Consumer Rescue exists.

Related: Cruise passengers tricked out of $6,000 by Travocart pretending to be Costco Travel

How to avoid losing your money after a missed cruise

There are lots of lessons in the Tangs’ cruise fiasco. If you want to make sure you never end up with thousands of dollars on the line after a missed cruise, keep these three tips in mind.

1. Never fly in on the same day your cruise departs

Don’t let a common occurrence like a flight delay upend your entire vacation plans. Scheduling to arrive in your port city at least one day before the cruise is scheduled to depart is the simplest way to guard against missing the boat.

2. When possible, book non-stop flights to your cruise port

Remember, the more connections you add to your itinerary on the way to your cruise port, the more chances you’ll have to hit a snag. Booking connecting flights on the same day as your cruise is a recipe for disaster.

3. Read and understand your travel insurance policy

Buying a travel insurance policy to protect your cruise is smart. But if you don’t understand how to use it or what is included in the policy, it could end up being a waste of money. Always read your travel insurance policy and carry the 24-hour hotline phone number with you at all times. If you have questions, that hotline will have answers.

4. Call the cruise line if you’re going to miss the ship

If you’re on the way to the port and it looks like you’re going to miss the ship, call the cruise line. Ask for your options and what you need to do to access those. Unfortunately, if you didn’t buy any travel insurance or protection, you’ll likely get nothing back.

If you miss the ship and have purchased travel insurance or travel protection, your next call should be to your provider.

The bottom line

Remember, if you miss your cruise because you didn’t arrive on time – even if it is through no fault of your own – and you don’t have a travel insurance policy that covers that type of cancellation, you won’t be getting a refund.

In that case, you’ll lose not only the cruise you were looking forward to, but also all the money you invested in it. If you plan your flights correctly and do your travel insurance research properly, that’s a cruise disaster you can easily avoid. (Michelle Couch-Friedman, Founder of Consumer Rescue)

Before you go: Cruise passengers beware: You don’t have an Enhanced ID!