Published: Updated:

Two more cruise ship passengers say they’ve been scammed during port stops in Nassau, Bahamas. However, the remarkably similar details shared by each of these solo travelers may leave you scratching your head.

Are there dangerous schemes lurking in beauty shops along Bay Street, or are these simply cases of extreme buyer’s remorse?

You decide.

Here are the latest cruise ship passengers to report their unpleasant experiences after accepting free facials in Nassau.

A Royal Caribbean passenger takes a solo stroll in Nassau

*Editor’s note: The cruise passengers in this article believe they are victims of crimes. As such, I’ve agreed to use pseudonyms. The factual details of their stories are unaltered.

Leap Day last year was a day that Royal Caribbean passenger Sue Magee wishes she could have skipped all together.

When RCCL’s Anthem of the Seas docked for a few hours in Nassau, she disembarked alone. Magee intended to take a short walk around the popular tourist area on Bay Street before returning to the cruise ship.

Unfortunately, her plans took an unexpected hours-long detour.

Magee says she didn’t get far before her solo female status caused her to be targeted by scammers.

“They [the scam ring] saw me walking by myself and pounced on me,” Magee explained. “A friendly lady offered me a free sample and a facial. She asked me to come inside a store called NWL Green Biotics.”

A big mistake: following a friendly lady into a shop for a free facial

Initially the invitation seemed innocent enough and Magee followed the woman into the shop. Once inside, her feelings abruptly changed.

A large, intimidating man named Charlie immediately handed me a glass of rum which I believe was altered. Within minutes I became incapable of thinking properly. I had no idea what was going on and I felt victimized and terrorized. I don’t know how long I was there, but I agreed to buy the cream so they would let me leave. The man yelled at me to sign something. I didn’t know what it was. It was all very frightening.

In her fright and confusion, Magee says she signed everything the man thrust in front of her.

Then the previously friendly lady who brought her inside in the first place reappeared. She handed Magee a shopping bag filled with much more than a jar of face cream and “pushed me out of the store.”

Soon Magee was standing outside, dazed and bewildered in the blazing heat. She staggered back to the ship with her purchases and crawled into bed feeling violently ill.

She remained in her cabin until the giant cruise ship disembarked in Bayonne, New Jersey a few days later.

Arriving at home with her surprise purchases in tow, her physical condition only became worse. When she logged into her Capital One account, she was horrified to discover two charges from NWL Green Biotics totaling $5,487.

Instantly, Magee was on the phone with Capital One, reporting fraud and disputing the jumbo charges.

A Carnival Freedom cruise ship passenger also gets a “free” facial

A year after Magee’s free face cream disaster, Carnival Cruise Line passenger Lori Barton had one of her own.

It was Valentine’s Day 2025 when Carnival Freedom stopped in Nassau after what Barton described as an unwanted itinerary change.

“When we booked the cruise the port was Bimini, not Nassau,” Barton told me. “I didn’t want to go there, but the cruise line says it has the right to change ports.”

Related: The cruise itinerary changes ruined my trip! Shouldn’t I get a refund?

Despite not wanting to visit Nassau, Barton chose to leave the ship that day. Similar to Magee’s plan a year earlier, Barton thought she would casually walk around the bustling cruise port.

Her plans were quickly interrupted by a young woman who wanted to discuss her skin care regimen. She had a free sample to share with Barton and invited her to come inside her air-conditioned beauty shop, Pearl of the Sea.

Barton didn’t sense any reason to reject the friendly invitation and went inside.

Even though it was just after 9 a.m., a big man coincidentally (or probably not so coincidentally) named Charlie welcomed Barton into the store with a shot of rum. The high-pressure sales pitch began immediately after her refreshment.

Related: How fake Carnival Cruise Line customer service is scamming passengers

Facial creams, devices and weight loss wands

After the facial creams were applied to her face, Barton says she noticed a significant difference in her skin tone.

“It seemed like it worked, so I agreed to buy the cream for $200,” Barton explained. “I thought then I would be on my way.”

She thought wrong.

📬 Subscribe to:

Tales from Consumer Advocacy Land

Real stories. Real rescues. Real advice.

Join thousands of smart travelers and savvy consumers who already subscribe to Tales from Consumer Advocacy Land — the friendly weekly newsletter from Michelle Couch-Friedman, founder of Consumer Rescue. It's filled with helpful consumer guidance, insider tips, and links to all of our latest articles.

Barton’s agreement to purchase the cream only let the salespeople know they had someone on the hook. Soon, more expensive products and devices were brought out from the backroom.

They told me that Mariah Carey uses all of these products and invests in the company. One was a weight-loss wand and another was a light machine for anti-aging. I told Charlie and his assistants I couldn’t afford any of it. But they kept bringing out more stuff that they said would improve my appearance – face masks, creams, serums.

After more rum, Barton understood Charlie to say that he could set her up on a payment plan for all the items. If she agreed to become a “spokesperson” for the products and pay just $27 per month, she could take the weight loss and skin renewal wands. He would give her a discount on those devices and give her all the creams and face masks for free.

That seemed like a manageable plan, Barton told me, so she agreed. Admittedly, the timeframe for the $27 per month payments and her duties as a spokesperson were entirely unclear.

Next, Charlie asked her to sign what she thought was a “declared value” document for insurance purposes. The information in front of Barton showed the value of the two devices at just under $10,000 with all the discounts applied.

Barton signed the form and took all her new products and devices with her back to the ship.

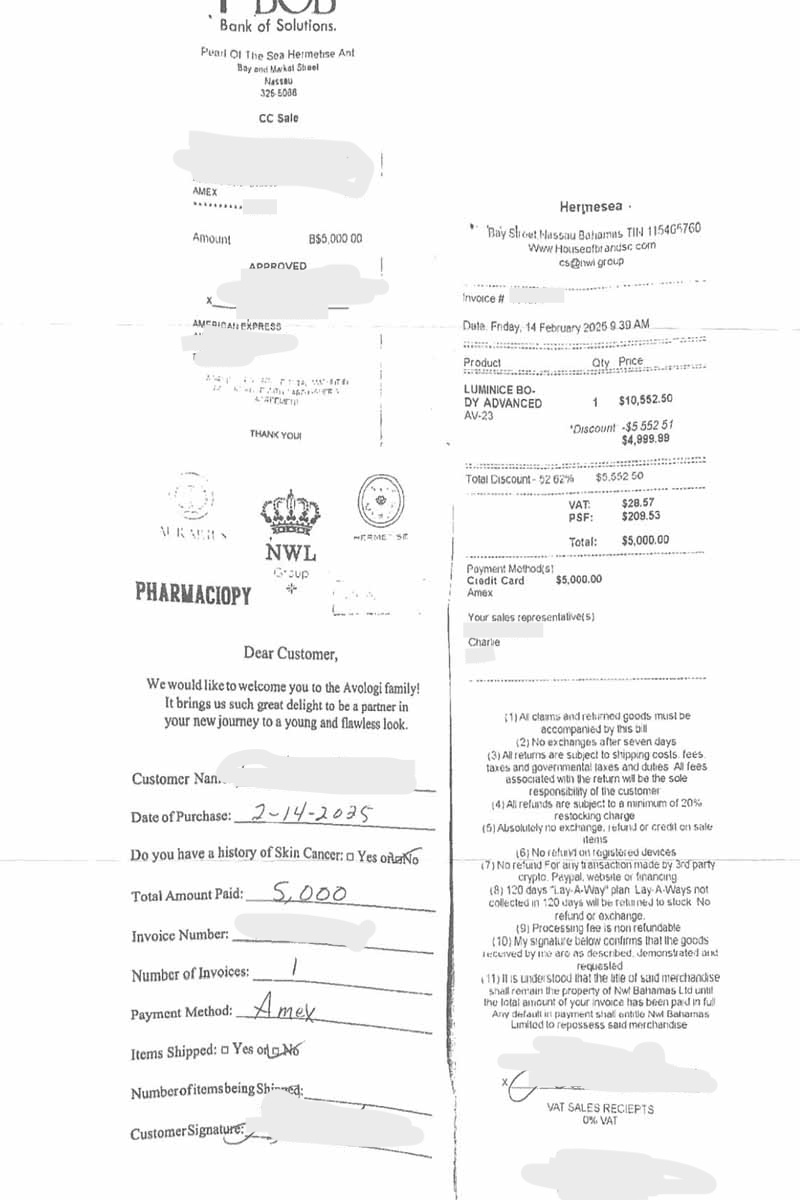

After the cruise ship was hundreds of miles from Nassau, Barton, like Magee, noticed that Pearl of the Sea, also affiliated with NWL Bahamas, had charged her American Express card nearly $10,000.

With a sickening feeling, she called her credit card company to report that she’d been scammed.

Related: You should not buy jewelry during your cruise. Here’s why

Consumer Rescue investigates: a sinister scam, buyer’s remorse or something in-between?

Although a year separated these two cruise ship passengers’ experiences, their requests for help landed on my desk at virtually the same time. These travelers had been battling with the parent company of the two shops (NWL Bahamas) and with their credit card companies since their visits to Nassau.

Both ladies had been led to Consumer Rescue because of my reporting here and at The Points Guy about cruise ship passengers reporting scams in Nassau.

Related: This couple says they were scammed out of $10,000 during a cruise port stop

In nearly all the cases I’ve investigated involving beauty shops in Nassau, the cruise ship passengers signed credit card receipts and took home products of high retail value. After they returned to the ship or back home, they filed credit card disputes alleging fraud.

All of these bewildered tourists have reported being plied with alcohol — often early in the morning. Repeatedly, cruisers have shared with me their suspicions that they had also been drugged. After all, many reasoned, how else could their extreme lapse in judgment — impulsively agreeing to buy such expensive devices they never planned for or wanted — be explained?

For the tourists who sign credit card receipts and sail away with the products or devices, fraud is almost impossible to prove.

None of the travelers whom I’ve interviewed have filed police reports, nor have they reported their suspected drugging to medical personnel onboard the ship.

Unfortunately, in the absence of medical and police reports showing drugs were used to manipulate the shopper’s decision, these transactions look more like something else: buyer’s remorse.

But Magee and Barton assured me they didn’t sign any credit card receipts.

So why did American Express and Capital One reject their disputes? That’s what I aimed to find out.

Why these sky-high credit card chargebacks were rejected

Recently, for Fodor’s Travel, I wrote about the misuse of the credit card dispute process.

Many consumers file chargebacks in ways that the Fair Credit Billing Act does not allow for. For instance, travelers can’t file a credit card chargeback because they’re suffering from buyer’s remorse. And yet many consumers do just that.

Related: You should never report a credit card charge as fraudulent when it isn’t

Magee and Barton both reported the sky-high charges on their credit card statements as fraudulent. Separately, they each told me that they had not signed receipts for these purchases.

When a credit card company investigates a dispute, it gives the merchant 20 to 45 days (depending on the type of card) to respond to the customer’s request to charge back the fee. If the merchant responds, the credit card company reviews the evidence and then makes a decision.

In the last step of this process, the credit card company provides the consumer with its findings, including the merchant’s response.

I reviewed those findings in these two cases.

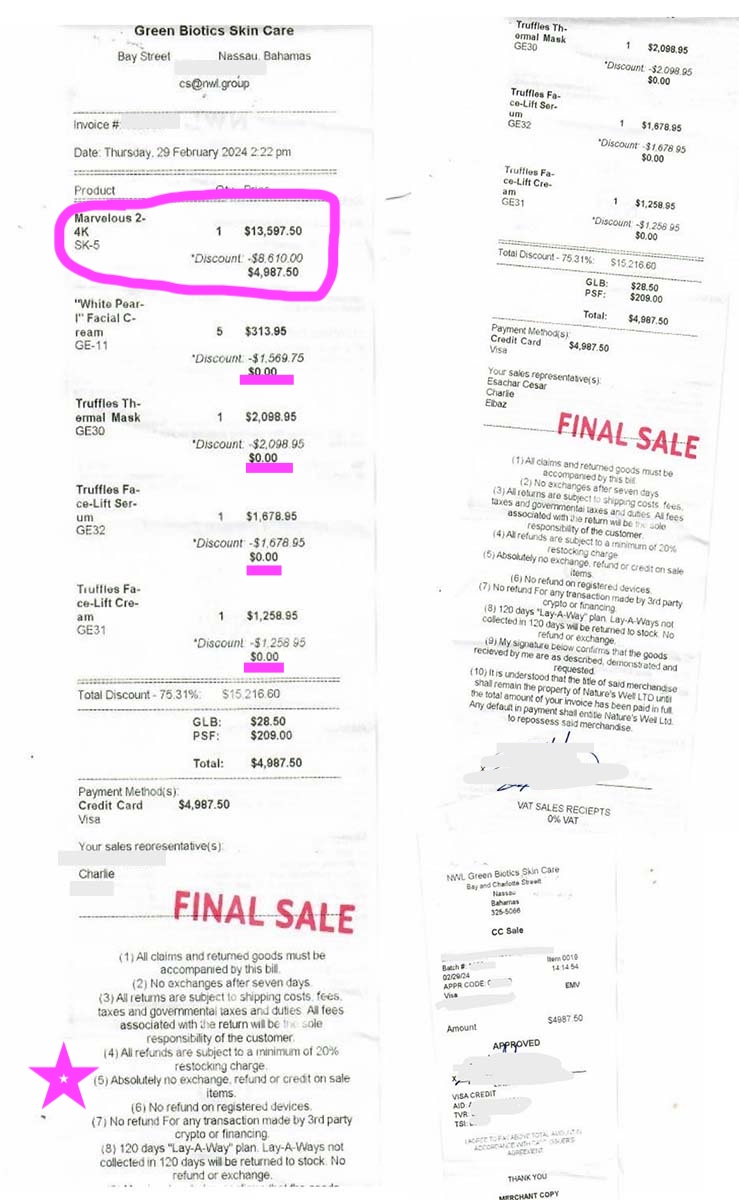

Green Biotics vs. RCCL cruise passenger Magee for $5,237

Magee was insistent in her conversations with me that she had lost her credit card disputes despite there being no evidence whatsoever that she had agreed to pay Green Biotics over $5,000. I asked to see the final determination from Capital One.

Hi Michelle,

I am certain that CapOne had no receipt and they did not send me a copy. As I said in my last email, they wanted me to go to the store’s bank for it. VISA had no copy of the receipt.

I have a cream and the machine.

Here are the letters I received from CapOne.

And that is when Magee’s case completely fell apart.

A lengthy paper trail, but receipts included

NWL Bahamas responded to her chargeback within days of the complaint. Despite her insistence that she hadn’t signed anything and that no one including Capital One had credit card receipts for her purchases, there was plenty of proof.

On the 13th page of the lengthy package she forwarded to me, there were two receipts stamped “Final Sale” with her signature at the bottom. Most of what was listed on those receipts had been given to her for free.

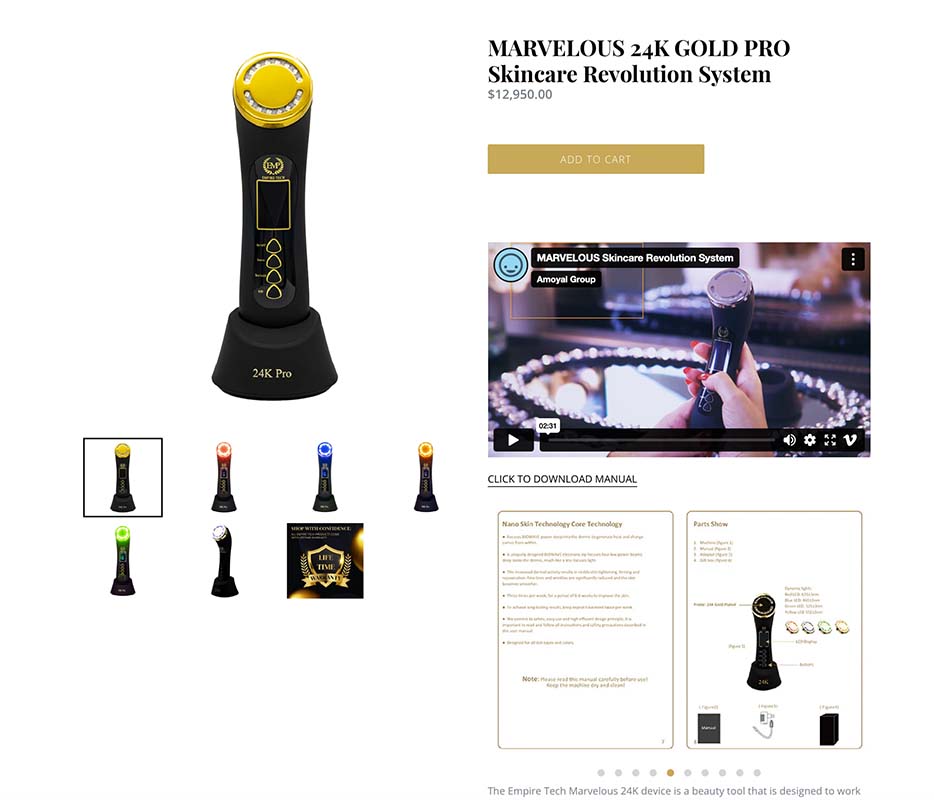

Her primary purchase was the “Miraculous 24K Gold Pro,” which, according to its manufacturer, retails for $12,950. Her signed receipt indicated that Green Biotics had “discounted” the machine to just under $5,000.

The reason for all the discounts was apparent on the receipt: “Absolutely no refund, credit, or exchange for sale items.”

Everything on Magee’s receipts was on sale.

Apparently, Magee had never made it to the 13th page in her credit card dispute package. She told me that she had never seen the receipts that she had just sent to me, but she understood the implication. I asked her if that was her signature, and she couldn’t say it wasn’t.

“This is still fraud. I believe I was drugged, probably with Ketamine. My doctor thinks so,” she told me. “I hope you warn people of this scam. I’m not giving up. None of this stuff is worth anything.”

It may very well be true that the items Magee paid $5,000 for are worthless. We don’t know. However, those signed receipts for the Marvelous 24K Gold Pro, leaves Capital One no choice but to allow the charge to stand.

Related: The Publishers Clearing House scam is thriving. Here’s the recorded call to prove it

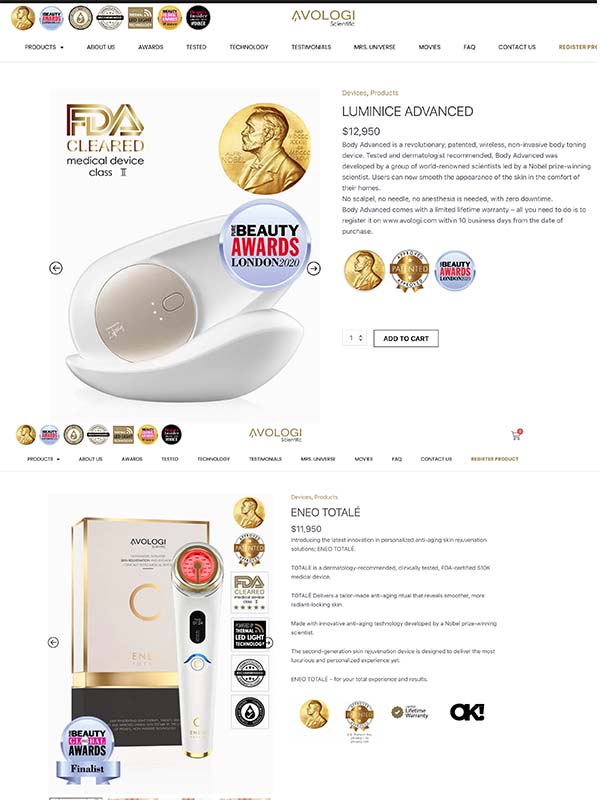

Pearl of the Seas vs Carnival Cruise Ship passenger Barton for over $10,000

Barton never suggested that she had been drugged, but according to her, she had been scammed just the same. In her case, she believed Charlie had offered to make her a spokesperson for the company, and in exchange, she could have the pricey devices for just $27 per month.

She also thought that no signed receipts existed that supported a $10,000 purchase.

Unfortunately, when I went through the final documents from her lost chargeback with American Express, the proof was there. Barton had purchased and taken home not one but two expensive light wand devices. Together, their retail value was an astounding $24,000 (according to the manufacturer).

NWL Bahamas provided copies of the receipts to American Express, which showed Barton’s flowery signature. That morning, there hadn’t even been much time for a hard sales pitch at all. The time stamp on the receipts shows 9:39 a.m.

“I realize this looks like buyer’s remorse,” Barton explained to me. “I still believe this is a scam and highly unethical. They lied about the purchase terms, as I would have never made a $10,000 purchase based on my financial situation. I hope you can alert more people so others can avoid this in the future.”

That is what I hope as well.

Related: Cruise passengers tricked out of $6,000 by fake Costco Travel

How to avoid being scammed or bamboozled in a cruise port

Cruise passengers beware: There are no shortages of scams and schemes operating out of the places where your ship will dock. That is especially true in the immediate area around the ports. Many of the shop owners and employees practice high-pressure sales tactics that many cruise passengers are unprepared for.

If you intend to stroll around Nassau or any other port of call, especially by yourself, you must prepare yourself.

Here’s what you need to know to avoid being scammed or bamboozled in a shop during a port visit.

1. Familiarize yourself with known scams and sales tactics

It’s always a good idea to do a little research before visiting any town you’re not well acquainted with. The U.S. State Department’s website is a great place to start. There, you can search all the countries you’ll be visiting and learn if there are any health, safety, or crime alerts.

The U.S. State Department also has a page dedicated to cruise travel. On that page, you can find tips and guidance, especially for cruise ship passengers.

You should also use Google to search for the latest reported scams and schemes operating out of the destinations you’ll be visiting during your cruise. For example, searching “scams + your destination + cruise passengers” can return some stories that will help you to be ready for any potential con artists that cross your path.

2. Set a budget for souvenirs or other purchases and stick to it

Ideally, before you leave for your cruise you should set a budget for your souvenir or other purchases. Certainly, before you step off the ship, you must have some idea about how much you can comfortably spend during a shore visit. Leave your credit cards onboard and only take the amount of cash in your budget if you think you’re an easy target for high-pressure salespeople.

If you’re in the market for high-priced jewelry, beauty devices, art or even a timeshare, it’s critical that you do your research long before you set foot in a shop or presentation. Again, make sure you keep your budget in mind and do not waver.

3. Never engage with people who approach you with free items

Remember, no one on the street wants to give you anything for free. That is a fact. The people who will approach you with free trinkets, face creams, drinks, etc., have the ultimate goal of extracting as much money out of you during your short port visit as possible. They’re not your friends and they only see you as a dollar sign.

Unfortunately, many cruise ship passengers I speak to who have been relieved of thousands of dollars didn’t want to be rude, so they followed the friendly stranger into a trap. Don’t let that be you.

Only walk into shops that you actually want to go into that are well lit with no shortage of other tourists coming and going.

4. Don’t accept free drinks during your visit

The only reason a shop owner would offer you a free alcoholic drink is to lower your inhibitions. You should never accept a shot of booze or an unidentified beverage of any type in a place not licensed to sell or serve alcohol. I don’t know if any of the people who have contacted me have been drugged, but what I do know is that accepting drinks from strangers in an unfamiliar place is dangerous.

If a shop owner or employee immediately hands you a shot of some type of booze, decline and head out the door. Nothing good is going to happen next if you don’t.

5. Always read any contract or receipt you sign

Although the ladies in today’s story were sure they didn’t sign any receipts during their fateful beauty shop visits, they had.

Always make sure to thoroughly read anything you are signing before you sign it.

Remember, if you sign a credit card receipt and take the product with you, your credit card company will not find in your favor during a dispute. That’s true even if you absolutely don’t want the item after you get home. Buyer’s remorse is not a valid reason to file a credit card dispute. BUT…

6. File a police report if you believe you’re a victim of a crime

If you believe someone has held you against your will, threatened or drugged you and then you’ve been released, it is imperative that you make your way to the nearest police station to report the crime. As I’ve mentioned before, in Nassau, there is a police kiosk very close to where the cruise ships are docked.

You must file a report if you believe you’re a victim of a crime. If you don’t, not only will you have no evidence to support your defense against whatever you were forced to buy, but you will make it possible for the scammer to continue their operation and victimize others.

If you’re fearful of filing a report in the port, then visit the customer service and security onboard your ship. Visiting the medical suite is essential if you suspect you’ve been drugged; you may be in immediate medical danger.

Related: 8 travel scams cruise ship passengers need to avoid right now!

The bottom line

Since I first reported on the free facial scams in Nassau, cruise ship passengers who have fallen for it have flooded my inbox. In fact, I’m sorry to say I received a new request for help right after these two complaints arrived. And Barton told me that she knows of at least three other solo female cruisers who have fallen victim to this scheme in Nassau.

Don’t let that be you. If you’re visiting Nassau and someone approaches you on the street with a comment about your skin, just ignore them. Keep in mind that the person with the friendly face standing in front of you only wants to sell you something you don’t want or need. (Michelle Couch-Friedman, Chief Fiasco Fixer and founder of Consumer Rescue)