Before you do any more online shopping, you’ll want to read about the scam that just ensnared Susan Leipholtz. She paid an online “merchant” $129 through PayPal and received absolutely nothing in return. But getting blindsided by the internet thief wasn’t nearly as shocking as what happened next. That’s when Capital One sided with the scammer in her credit card dispute.

Now a shell-shocked Susan is asking us to retrieve the money stolen from her in this online shopping scam.

But can we do it?

Jump right to:

Shopping online for an air fryer — but finding a scam instead

This scam began as Susan was trying to find ways to eat healthier. She had heard good things about air fryers, which provide the tastiness of fried food without using oil. The product sounded like a great idea.

“So I started shopping for an air fryer online, but I seem to have found a scam instead,” Susan lamented.

In her virtual shopping excursion for the Ninja Digital Air Fryer, Susan had definitely made a mistake. Having browsed a variety of sites, she zeroed in on the merchant with the lowest price.

“I paid $129 to this merchant, and I used Paypal,” Susan explained. “I paid for it with my Capital One credit card.”

After hitting “purchase,” Susan received a confirmation and assumed that the transaction was successful.

Little did she know, the transaction was very successful — but not for her. An anonymous scammer was the beneficiary.

It wouldn’t be long before some unsettling alerts arrived about her new online purchase.

“Dear PayPal, help! I’ve been hit by an online shopping scam.”

Just days after Susan placed her order, she received a confirmation of delivery. Surprised by the swift delivery, she excitedly walked to her front door to gather her package and maybe whip up a tasty lunch. There she was somewhat alarmed to see no package, no Ninja Air Fryer — nothing.

“I sent an email to the merchant and PayPal,” Susan recalled. “I definitely didn’t receive my air fryer.”

A few minutes after asking the merchant for additional information about the delivery, Susan received another unsettling piece of information.

“The merchant’s email account was deactivated and no longer valid,” Susan reported. “I started getting an awful feeling.”

That bad feeling was about to escalate into an even greater frustration when PayPal responded.

“PayPal told me that they would not be able to help me since I received the product,” Susan recalled. “It was like no one was listening to the actual details of my case.”

Unfortunately, Susan experienced what many PayPal users have experienced during the pandemic — customer service representatives who may or may not be human.

Related: How did a hacker get into my PayPal account?

But Susan wasn’t about to give up so easily.

Filing a dispute with Capital One about this online shopping scam

As I pointed out in my article about how to use credit card disputes in the right way, the Fair Credit Billing Act allows consumers to file chargebacks in cases of billing errors and fraud.

Susan knew she qualified for a successful credit card dispute as a victim of fraud. After all, this fake merchant had sold her a nonexistent air fryer for $129. She filed the chargeback and assumed that Capital One would do the rest for her.

She was wrong.

This brazen scammer actually fought the credit card dispute. He provided the invoice and a delivery confirmation number from the United States Postal Service to Capital One.

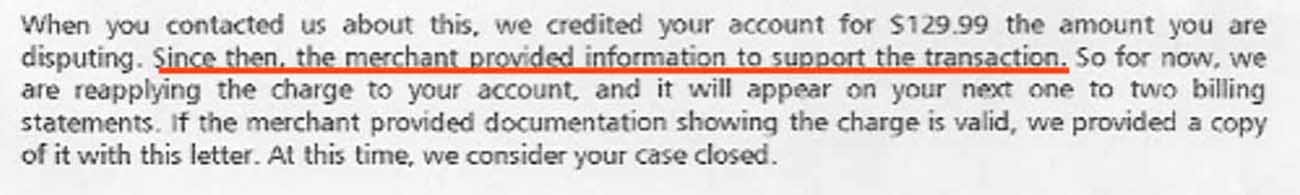

Case closed, according to Capital One. It quickly resolved the credit card dispute in favor of the scammer.

Now what? Susan thought of one last possibility — asking our advocacy team for help.

Asking our advocacy team to investigate the truth about this transaction

“I couldn’t believe it,” Susan lamented when contacting our advocacy team. “You’re my last hope.”

By the time Susan reached out to our advocacy team for help, she had been fighting PayPal and Capital One for several months. She felt particularly upset because she thought that both companies provided substantial protection against scammers.

When I reviewed Susan’s paper trail, her tenacity and investigative skills amazed me. She had done so much on her own behalf. Her own evidence made it clear that she was absolutely a victim of an online shopping scam.

We have a very helpful executive at PayPal, and so I thought we could quickly correct this situation.

But in this case, I was wrong.

PayPal: This “merchant provided information to support this transaction.”

Our PayPal contact declined the case. She told me that it was now in the hands of Capital One.

Hi Michelle,

On background- once a chargeback is opened with the card issuer, there’s nothing more we can do per our agreements with the card issuers. Capital One will have to resolve this one.

Best,

**** (PayPal to Michelle)

Darn!

Ok, with that door closed, it was time to see if Capital One could help. We needed to find out why Susan lost this credit card dispute despite the clear evidence that she was a victim of an online shopping scam.

So I turned my sights on Capital One, which had sent this denial of the credit card dispute. And even though it’s been quite a while since our last case involving Capital One. I hoped their team could help.

Asking Capital One to take a look at this online shopping scam with a phony shipping number

But this information that I read in the paper trail proved beyond a doubt that this merchant was fake.

We have a PayPal/Capital One customer here who has been scammed. Susan Leipholtz purchased an air fryer for $129 from a merchant paying for it using PayPal (funded through her Capital One card). The “merchant” appears to be in China but somehow pretended to ship the item through the USPS in just a few days. This “merchant” provided a shipping number to PayPal when Ms. Leipholtz complained that she never received the item.

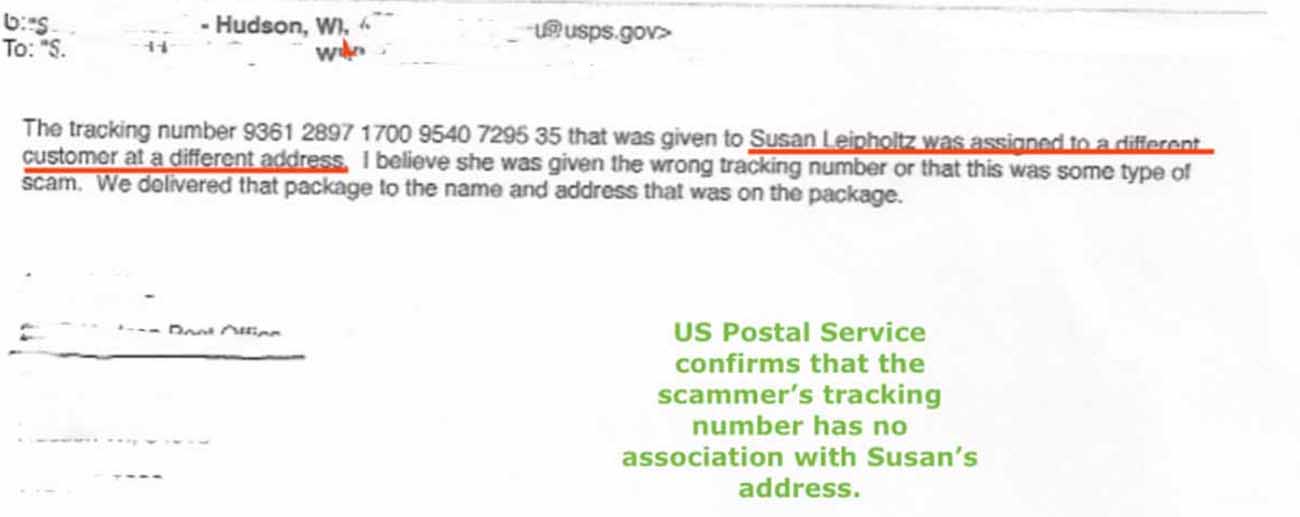

The USPS representative has confirmed that the shipping number given to PayPal and Capital One is NOT associated with Ms. Leipholtz OR her address. But both PayPal and Capital One seem to have accepted the phony shipping number and confirmation of delivery as proof that this “merchant” sent the product (even after the US Postal Service confirmed that the tracking number was fake).

This is most definitely a scam — all email addresses associated with this seller have now been disabled. I’m including the relevant screenshots under my signature to support Ms. Leipholtz’s fraud complaint — including the explanation from Capital One about why it rejected her chargeback dispute. It appears that Capital One relied on the fake shipping number to find in favor of this fake merchant.

Could you see if your team can have a close look at this case and help get Ms. Leipholtz’s $129 back for her? Thank you! 😊 (Michelle to Capital One)

I included a statement from the US Postal Service that confirmed that the tracking number this scammer provided to PayPal and Capital One wasn’t connected to Susan’s address. (By the way, this information is not hard to confirm. The USPS has a tracker confirmation tool that can let you know when and where a package was delivered. Other shipping services such as UPS and FedEx have the same type of tools.)

Related: Walmart promised me a $1,297 refund. Instead, I received a $10 online coupon

The really good news! A reversal of the credit card dispute from Capital One

After I contacted Capital One, their team took a second look at Susan’s case and its evidence. I soon received a phone call from their team.

The upshot? Capital One now found the credit card dispute in favor of Susan, and she received her refund.

The official statement from Capital One is as follows:

Discovering that you’ve been a victim of fraud can be alarming and frustrating. We urge our customers to be careful about offers that appear to be too good to be true and research the company offering the suspicious promotion to see what other customers have to say.

In cases where a customer feels they have been defrauded by a merchant or that the goods they received were not as promised, we always encourage customers to reach out to us directly so we can initiate a dispute on their behalf. (Capital One official statement)

And although this is sound advice, the fact is that the deal offered in this online scam wasn’t even a great bargain. 🙁

But Susan has learned a lesson, and the lowest price will most certainly not be her most important criterion in future online shopping trips!

How to spot and avoid an online shopping scam

There are literally millions of online shopping sites available today – and nearly as many scam opportunities. Fake merchants (just like fake Vrbo owners) easily set their trap, quickly take advantage of a victim, and just as swiftly vanish — only to begin again at a different online location. So it’s up to the consumer to protect themselves and do the research before setting off on a retail excursion. Here are some tips to help you increase your ability to spot and avoid an online shopping scam.

- Use established merchants

About half a million websites are created and uploaded, adding to the clutter of the internet every day. A giant chunk of those are scam sites specifically set up to steal your money. Buying anything from a merchant with no online track record dramatically increases your chances of getting snagged by one of these fraudulent sites. It’s best to stick with merchants who’ve been around a while. Look for online reviews of the site and ask for recommendations from trusted acquaintances. - Beware of too-good-to-be-true and urgent deals

Online shopping scams typically all have one thing in common: they offer fabulous deals. Often these bargains are “time-limited” or “limited quantity.” Unfortunately, many consumers get blinded by the (truly) unbelievable savings and neglect to take a closer look at the site. The ability to create a sense of urgency in the shopper is a necessity for an online scammer. If a merchant advertises products way below prices found anywhere else, take it as a strong warning sign. Remember what your mother may have told you — If it sounds too good to be true, it is. - Try to reach customer service before you make the purchase

It’s a good idea to reach customer service before making any purchases with a company. This is the best time to find out what it would be like if you needed to reach them after a purchase. Ask questions about the return policy or product information. If it is extremely difficult or impossible to reach anyone in customer service prior to buying anything, you can be sure no one will respond more quickly when you have a real problem. It’s best to take your business elsewhere. - Use Google Maps and find out where the company is located

Scammers obviously don’t want you calling or stopping by for a visit, so fraudulent websites are typically missing an information page. BUT some scam sites might list an address. It’s always a good idea to put that address into Google Maps and see if it exists and what is located there. You can find lots of great information by doing a little sleuthing with Google Maps. - Only pay with a credit card

If a company will only accept payment via a cash app like Zelle or Venmo, it’s best to keep strolling through the virtual internet mall. Remember, you have absolutely no buyer protection using a cash app for a purchase. It’s the same as if you handed over a pile of dough to a total stranger on the street. Debit cards can provide some protection, depending on the bank. But the Fair Credit Billing Act only protects credit card purchases, so that is the safest way to shop anywhere. And remember, cash apps seem to have replaced wire transfers as the preferred payment method of scammers. So treat the request for a cash app payment as a warning sign. - Is the website secure — HTTPS?

You can find a critical clue about a website’s level of professionalism and legitimacy at the top of the page in your browser. All established websites should have converted from the HTTP (nonsecure) format to HTTPS (secure and encrypted format). In 2018, Google began to display a warning on all sites that neglected to make the switch. Of course, scammers have no desire or need to comply with this request designed to protect consumers. So although an HTTP URL isn’t proof that a website is a scam site, it’s another warning sign about the business. You should never hand over a credit card to a merchant who refuses to adapt to modern-day technology. After all, if they’re that sloppy with their website — scammer or not — you don’t want to put your personal information in their hands. (Michelle Couch-Friedman, Consumer Rescue)

Before you go: Here’s a different type of shopping scam — the kind that happens at Walmart.