Published: Updated:

Ph.D. student Rayhan Rashed doesn’t have a personal vehicle or auto insurance. So when he recently booked a rental car for the first time, he wisely purchased Hertz’s Loss Damage Waiver (LDW). As it turns out, he would definitely need it.

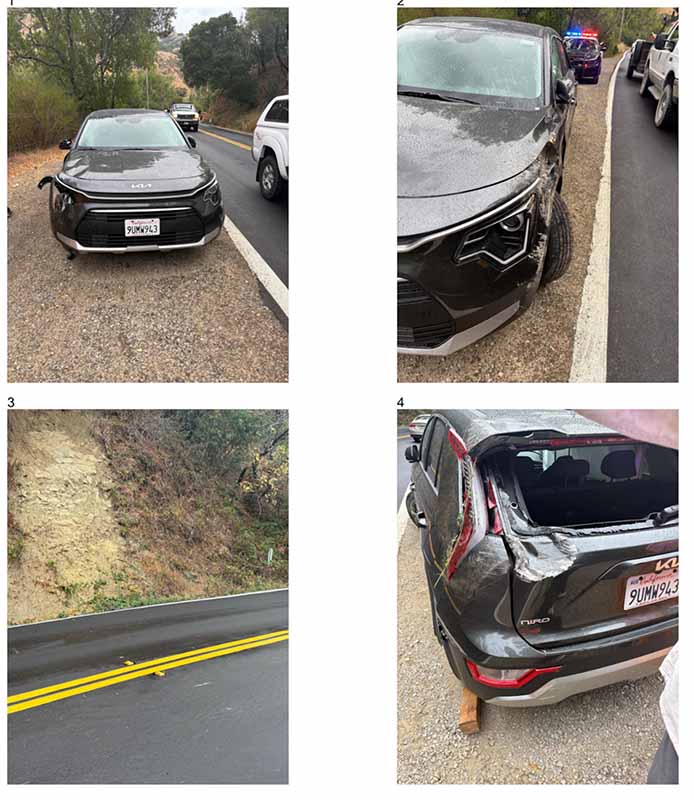

He crashed that rental car on a twisty California road less than 24 hours later, totaling it.

The good news was that Rashed and his wife, who was traveling with him, were unhurt in the one-vehicle accident. The bad news is that since then, Hertz has been demanding that Rashed pay a $1,900 impound fee. The car rental giant says the charge resulted from a police investigation and isn’t covered by LDW.

Now Rashed is hoping Consumer Rescue can help. He’s certain that the Hertz agent sold the pricey LDW to him as “full coverage.”

But he has something even more compelling to share.

He doesn’t believe the police ever impounded the rental car. Rashed suspects that Hertz just neglected to promptly collect the damaged vehicle and wants him to pay the price.

So what’s really going on here? That’s what I aimed to find out.

A rental car crash on an unfamiliar rural road

Last September, Rashed and his wife flew to San Francisco where they rented a Kia Niro at the airport. It was past 10 p.m. when the couple drove away in the small SUV.

In the morning, they intended to begin exploring the picturesque valley just north of the city.

And that is exactly what the couple did the next day — at least for a little while.

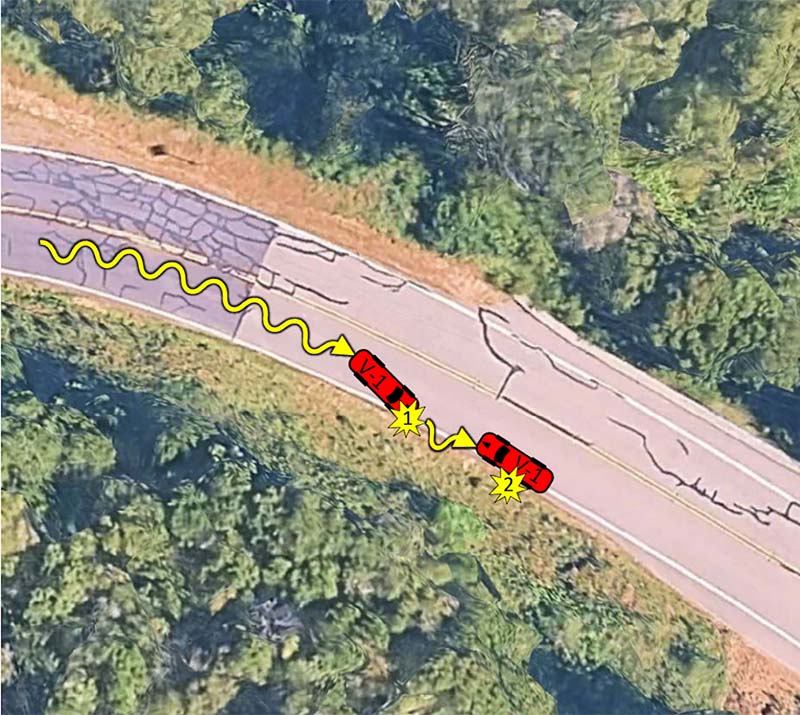

Unfortunately, they didn’t get very far before all their plans changed. Rashed was driving the small Kia down a scenic winding road when he lost control of the rental car. Lucas Valley Road is known for its somewhat treacherous conditions with a succession of sharp curves for miles. It’s lined with trees and a hard embankment on one side and a steep drop-off into the valley on the other.

Drivers must stay alert as the speed limit rapidly fluctuates from 45 to just 15 miles per hour.

“I wasn’t going very fast — maybe 35 to 40 mph, when I saw the warning for the curve,” Rashed recalled. “I slammed on the brakes and the rental car hit the embankment then spun into the center of the road.”

Luckily, there were no oncoming vehicles at that moment, and the rental car came to rest in the opposite lane rather than sliding over the precipice. Rashed was not injured and quickly checked on his wife, who was shaken up but otherwise fine.

The crash totaled the rental car

The Kia Niro was not as lucky. The crash had severely damaged the vehicle, leaving it inoperable. It was also blocking traffic in both directions on the limited-access road.

Rashed immediately called 911 and Hertz’s roadside assistance as traffic began to back up. When the police arrived they pushed the rental car off the road to wait for the tow.

“We had no choice in the matter,” Rashed says. “Our rental car wasn’t driveable and the police said they wanted to remove it right away. They agreed to wait 15 minutes for Hertz’s tow, but it never showed up. So they (the police) called for a local tow truck.”

After the police had the rental car towed away, the shell-shocked couple headed back into San Francisco. Rashed called Hertz to report where the damaged Kia was located. When the car rental company offered a replacement vehicle, he declined.

“That was enough driving for me. I was feeling unwell,” Rashed told me. “But it was a relief to know that the LDW would cover all the costs of the car crash.”

And it should have — but Rashed would soon find out Hertz had a little surprise for its frazzled one-time customer.

Hertz: “The Loss Damage Waiver won’t cover the impound fees on your rental car.”

In October, after the couple had returned home from their California misadventure, Rashed noticed something unusual on his credit bill. Instead of the expected $700, Hertz charged an eye-popping $2,600 for their one-day rental. In a flash, Rashed was on the phone talking to customer support.

“The first agent told me that the extra $1,900 covered the rental car’s impound fee,” Rashed recalled. “I told her that I had LDW coverage so they needed to remove that charge.”

This task appeared to be beyond the phone agent’s ability to fix. She told Rashed he would hear from Hertz in a few days.

Initially, Rashed was confident that the problem was just a billing mistake and that it would be easily cleared up.

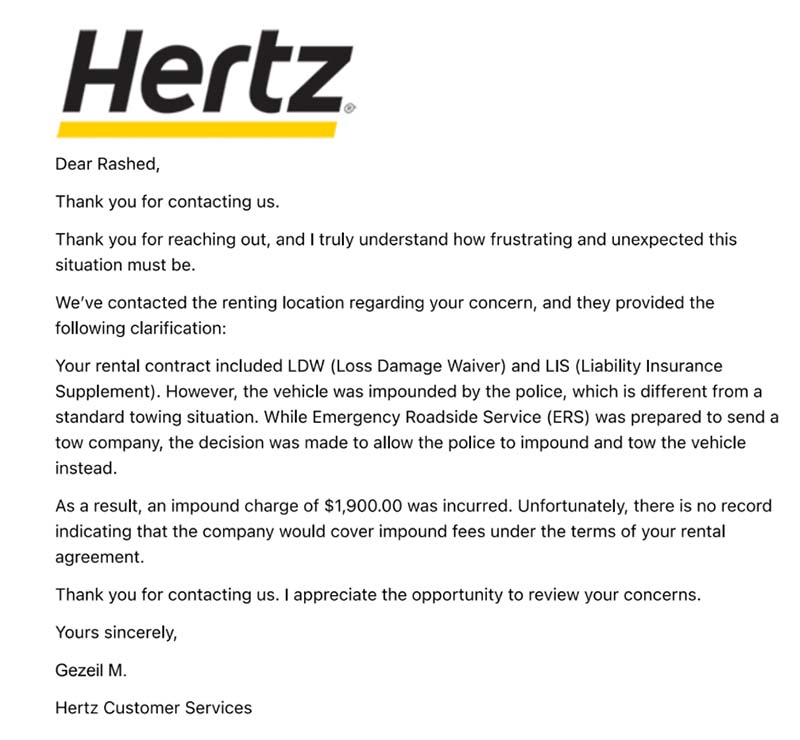

But soon he received the first in a series of frustrating emails from Hertz.

While Hertz acknowledged that Rashed had purchased Loss Damage Waiver, the local branch claimed:

“The vehicle was impounded by the police, which is different from a standard towing situation. As a result an impound charge of $1,900 was incurred.” [Hertz Customer Service]

When Rashed tried to reason with the agent, Hertz went silent and the charge remained on his credit card.

Why a credit card dispute will not solve a complaint against a car rental company

Frustrated by what he believed to be Hertz’s mistaken interpretation of the LDW, Rashed filed a credit card dispute. He won the chargeback and thought that would be the end of the unpleasant experience.

If you’re a regular reader of my column, you already know what the car rental giant did next. There was no chance that Hertz would allow the credit card dispute to end its pursuit of the $1,900 impound fee.

📬 Subscribe to:

Tales from Consumer Advocacy Land

Real stories. Real rescues. Real advice.

Join thousands of smart travelers and savvy consumers who already subscribe to Tales from Consumer Advocacy Land — the friendly weekly newsletter from Michelle Couch-Friedman, founder of Consumer Rescue. It's filled with helpful consumer guidance, insider tips, and links to all of our latest articles.

Rashed barely had time to breathe a sigh of relief before collections started calling, demanding he pay the $1,900. That’s when he started researching his predicament and came across the many articles I’ve written about car rental mistakes and scams. That’s how he learned why his efforts to win the credit card dispute were in vain.

The Fair Credit Billing Act (FCBA) protects credit card users from fraudulent charges and billing errors. Consumers often misunderstand the limitations of the FCBA and assume it is a magic bullet for settling disputes with companies. The reality is that the process is flawed. Winning a chargeback dispute only definitively ends the credit card company’s involvement in the situation. The merchant is always free to pursue the disputed debt elsewhere.

Related: How a credit card dispute can end with you in jail (My report for Fodor’s Travel)

Car rental companies nearly always just move the debt from the consumer’s credit card to a collection agency at the end of the chargeback. As an added bonus, the customer’s name goes onto the Do Not Rent list of the parent car rental company and all the brands under its umbrella.

Related: Your car rental company has a Do Not Rent list. Here’s how to steer clear of it. (My report for The Points Guy)

For most car rental customers hoping to fix a problem, winning (or losing) a credit card chargeback will just make things worse. These are wasted efforts. The focus, instead, should be on finding ways to escalate the dispute to someone within the company who can and is willing to look at the evidence.

Unfortunately, sometimes that is only possible by first bringing the problem to someone who knows how to reach that type of person.

Like a consumer advocate.

Consumer Rescue investigates: Was there a police investigation that impounded the rental car?

Spoiler alert: The answer is no, the police did not impound Rashed’s rental car or conduct an ongoing investigation into his crash. I reviewed the police report, which includes interviews with both Rashed and his wife and a third-party description of what happened. He didn’t receive any tickets or warnings.

The police called for a local company to tow the rental car because Hertz’s roadside assistance didn’t dispatch a truck quickly. Authorities needed to clear the narrow road.

This car crash wasn’t hard to figure out. It was simply the result of an inexperienced driver on an unfamiliar road slamming on the brakes and briefly losing control.

The paper trail also showed that the local Hertz branch didn’t go looking for the rental car until a week after the accident. By then, the storage fees, not impound fees, had risen to $1,900.

What does Loss Damage Waiver cover on a Hertz rental car?

When Rashed reached out to me just before Christmas, he was distraught. That fee was weighing heavily on his mind.

“I don’t have that type of money laying around. I am here on a student visa and I don’t have any family that can help,” Rashed told me. “We are on a limited budget and this is a horrendous burden and stress. I bought the Loss Damage Waiver for peace of mind. Now Hertz is misinterpreting what happened and I’m the one expected to pay. Can you help me?”

The paper trail Rashed sent me was complete with all his correspondence with Hertz as well as the police report. His contract clearly showed he had purchased multiple insurance products, including the Loss Damage Waiver.

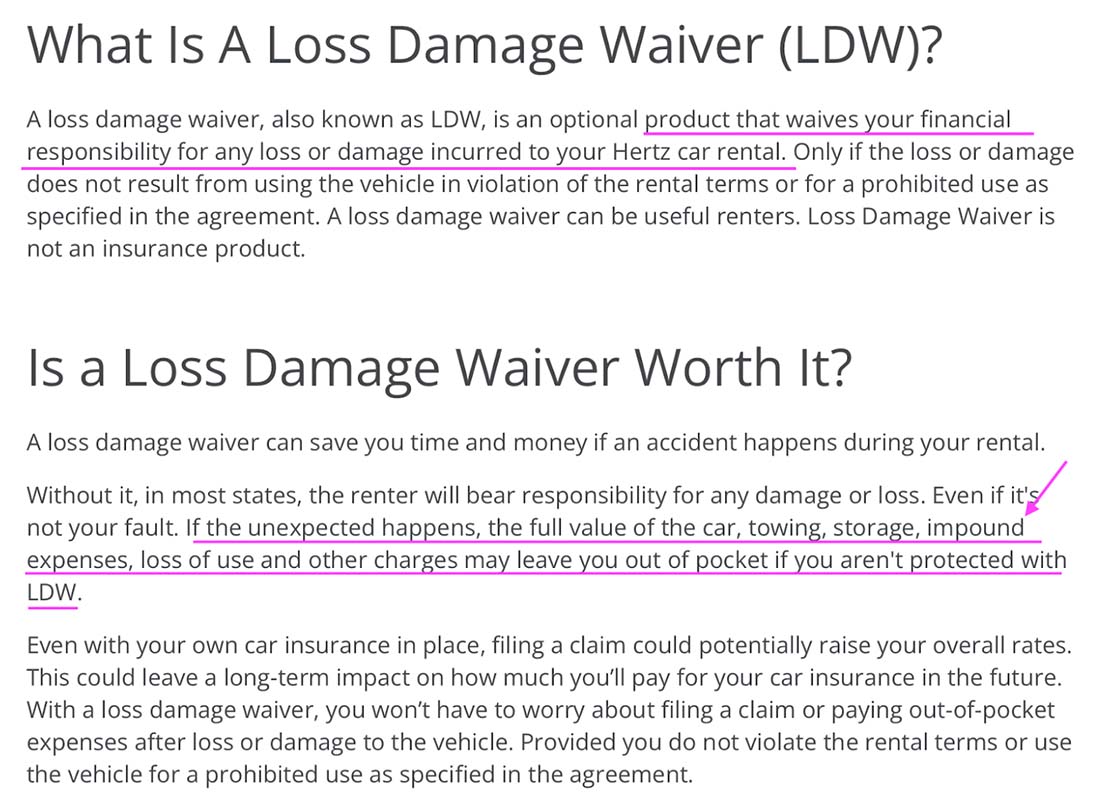

Loss Damage Waiver (LDW) adds a high cost to a rental car contract. It’s a daily charge, but it covers nearly anything that happens to the car. It can be a lifesaver (or at least a financial one) in situations like the one Rashed found himself in. In fact, Rashed’s recollection of how the Hertz agent had framed the protection aligns with what Hertz advertises it as:

Hertz’s description of its LDW warns that, “If the unexpected happens, the full value of the car, towing, storage, IMPOUND expenses, loss of use and other charges may leave you out of pocket if you aren’t protected with LDW.”

Yet, Rashed was “protected with” Hertz’s LDW, and the company was still leaving him “out-of-pocket,” as their guide on the topic called it.

The only way Rashed would be responsible for that impound fee would be if he had been violating his rental car contract prior to the accident. There was no evidence anywhere that suggested Rashed had done anything wrong, except brake too hard.

It was a simple driving mistake that had led to months of emotional distress and hardship on the couple’s finances.

Asking the Hertz executive team what went wrong with this LDW coverage

It was time for me to ask our always-helpful Hertz executive what was going on out there in San Francisco.

Happy New Year!

I have a young Hertz customer here in great distress. Rayhan Rashed (Hertz RA: ****) is a graduate student who rented his first car in September. Unfortunately, it didn’t go well, and on the second day of his rental, he crashed the car. The vehicle was inoperable after the accident, and although Rayhan called Hertz Roadside assistance, the police towed the car away because it was blocking the road.

The good news is that he had purchased Hertz’s LDW protection. But…

Rayhan says he followed all the instructions from Hertz, but a few weeks later he received a bill for $1,900 for storage and impound fees.

From the paper trail, it looks like the local Hertz for some unknown reason allowed the vehicle to stay in the impound lot for many days and then billed Rayhan.

Rayhan is an international student on a strict budget and has been trying to have this charge removed for the past 4 months. However, Hertz is now sending him to collections. It seems like something went wrong here. Could your team take a look and see if there is a billing error?

Thank you! Michelle

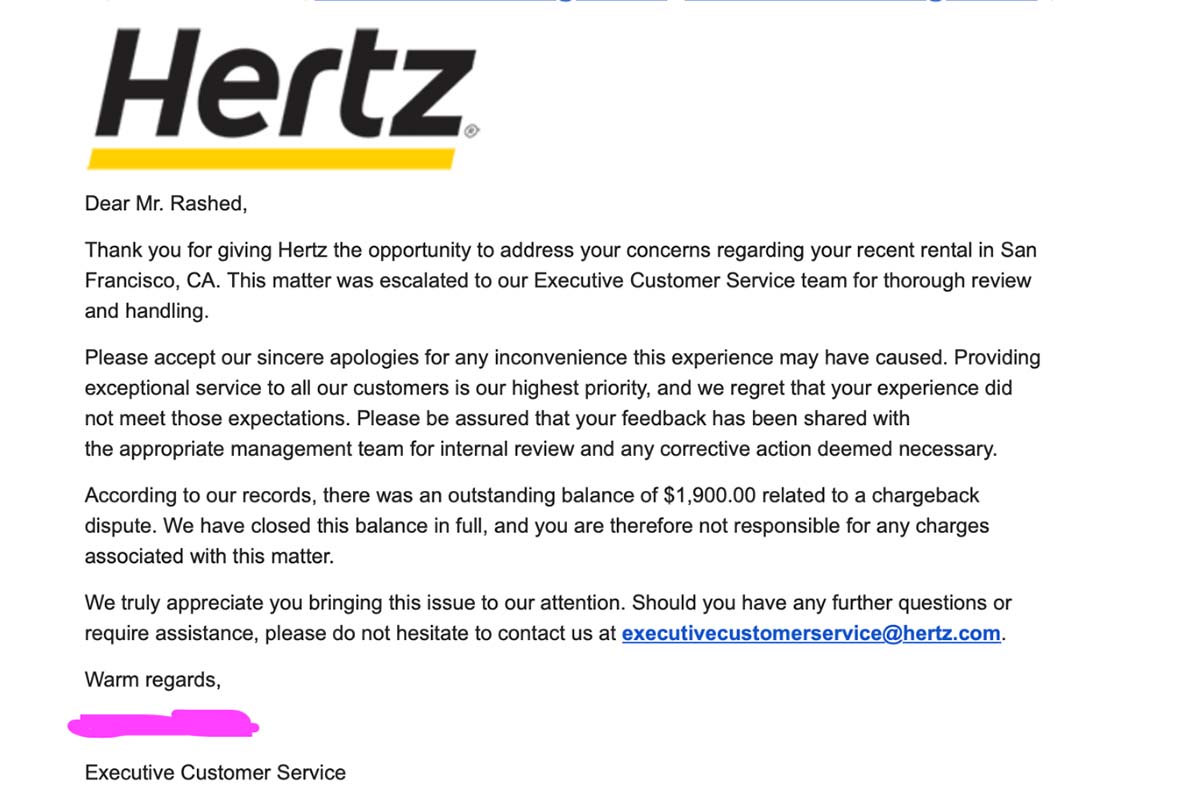

The good news and then… more demands for $1,900

Very quickly, Rashed’s three-month battle came to a positive conclusion (at least it seemed like it). A Hertz executive customer service supervisor apologized for the local branch’s misunderstanding of LDW coverage. The Loss Damage Waiver does, indeed, cover storage and/or impound (as long as the customer was not in violation of the contract).

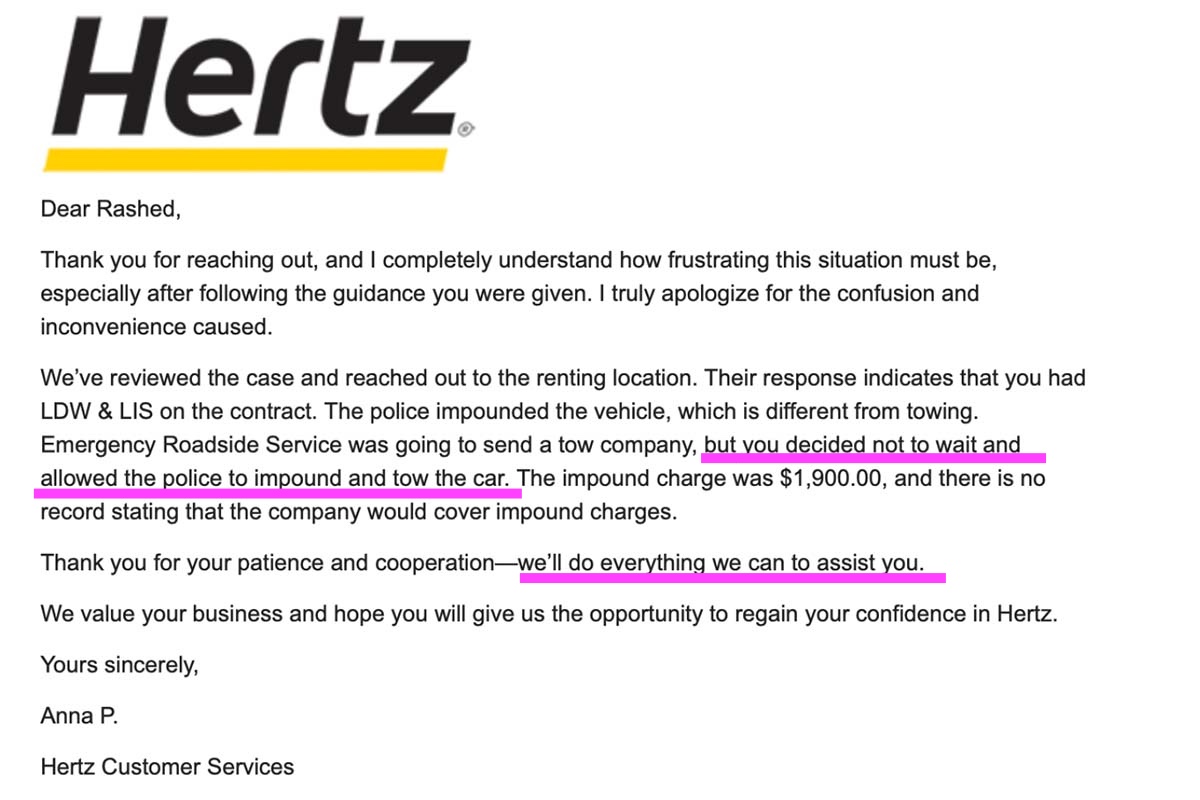

But then unbelievably, two days later, Rashed heard from Hertz’s Anna P.

Related: Here it is: the worst car rental experience so far this year

One more try to collect the impound fee

This next Hertz agent reiterated that Rashed still owed the $1,900 because he “allowed the police to impound and tow the car.” (As if he had a choice to reject the tow.)

“Michelle, what do I do now? I think this is never going to end,” Rashed emailed me.

I couldn’t quite believe it myself.

Related: Would Hertz offer a goodwill gesture and then send a customer to collections?

Finally, this car rental nightmare is over

So, back I went to the executive team at Hertz. I showed them the two competing messages from Hertz.

And finally, without doubt this car rental nightmare was over for Rashed.

The corporate executive team reached out directly to Rashed and apologized and confirmed the LDW was covering all the fees. He was not responsible for any towing, impounding or storage for the Kia he crashed that fateful day above San Francisco.

The couple is beyond relieved.

Thanks, Michelle, for helping!

It feels like magic. I got an email from Hertz Executive Customer Care that the charges have been dropped and that they are really sorry. Feels like an end to three-months’ long fight and harassment.

Rayhan Rashed

Rayhan’s wife shared her experience with Facebook:

On January 5th, the very first working day after the holiday break, Michelle immediately stepped in and contacted Hertz on our behalf. What happened next honestly felt unreal: within 1–2 days, we received an official written confirmation from Hertz stating that we are no longer responsible for the $1,900 charge.

After months of stress and zero progress on our own, Consumer Rescue resolved the issue almost instantly. No fees. No hidden expectations. Just genuine advocacy and integrity.

Organizations like Consumer Rescue restore faith in consumer protection. Michelle and her team are knowledgeable, determined, and truly care about helping people who feel powerless against large corporations.

If you’re dealing with an unfair consumer issue and feel stuck, don’t hesitate—Consumer Rescue is the real deal. We are beyond thankful.

Tahiya Chowdhury

That warms my heart. You’re both very welcome. I’m happy to have been able to help, and I hope your next car rental goes much better!

How to fight unfair rental car towing and impound fees

There is no question that Hertz’s Loss Damage Waiver (LDW) protection covers towing or impound fees. That is, unless the driver was in violation of the contract in some way.

Here’s what you can do if you pay for LDW and your car rental company still asks you to pay.

Related: His rental car crashed into the sea. Now he’s in a $28,000 insurance nightmare

Confirm your LDW coverage

Recently, I had a car rental customer contact me, certain that they had purchased LDW protection. However, the contract told a different story — he had actually declined the coverage, with devastating financial consequences.

Any waiver products added to your rental will be indicated on the contract along with a daily rate. If you intend to buy it, you must make sure that it is added to your contract before you drive away from the lot.

Understand how to use the LDW protection

As with any waiver or insurance product, there are terms that the consumer must agree to and steps to follow to ensure that they don’t inadvertently void the protection. For LDW provided by Hertz, customers must promptly notify roadside assistance and the company after an incident.

There are also driver behaviors that will void the protection. Of course, illegal activities such as drinking and driving will make LDW coverage worthless. But other violations of your contract will do the same, such as allowing someone unauthorized to drive the vehicle or driving the rental car into forbidden areas.

Follow-up with the car rental company

Regardless of what type of coverage you have, it is crucial that you find out exactly where the towing company is taking your rental car. Keep in mind that you are responsible for that vehicle until the rental car company closes the contract. It’s important to provide the car’s location to the company and keep checking back until you receive confirmation that your contract is closed.

Related: What can I do now? My rental car went missing after a tow truck took it away

Do not file a credit card dispute as a first line of defense

Frustrated consumers often file chargebacks with the mistaken belief that the outcome is binding. But for many car rental customers, the successful end of a credit card dispute is just the beginning of a new battle. They learn too late, as Rashed did, that although the merchant can no longer charge the fee in question to the original credit card, they can send it to collections.

Car rental companies nearly always ignore credit card disputes. After the consumer wins the chargeback, their name is added to the Do Not Rent list. The outstanding balance is turned over to a debt collector.

Related: Credit card disputes: Here’s everything you need to know before you file one

Instead of filing a credit card dispute, escalate your complaint to the next level of customer service. If you need help finding a real person to contact at Hertz (or any other company), you can use Consumer Rescue’s Research Valet. Tell us what business you’re struggling with and we’ll tell you the name and contact of someone there who we know has a history of helping.

Ask Consumer Rescue for help

Of course, if you’ve tried your best to fix your car rental problem and need backup assistance, Consumer Rescue is here to help. Send your request to our advocacy team, and we’ll investigate. If the facts are on your side, we’ll take your case to mediation. Our service is fast, friendly, and always free! (Michelle Couch-Friedman, Chief Fiasco Fixer and founder of Consumer Rescue)