Could you fall for a fake job scam?

If you’re like Sam Erin, you probably answered, “no!” She’s a college-educated young adult who was sure she knew how to spot a con game. That is until a phony employment crime ring she found on LinkedIn preyed on her naivety and stole nearly $9,000 from her.

Now, after draining her bank account, the scammers have vanished, leaving Erin jobless and cashless. She’s hoping our advocacy team can help. But how?

It’s no secret that the pandemic caused unemployment levels to soar. Unfortunately, criminals seized on that opportunity, and fake job scams skyrocketed as well. If you or someone you love is currently searching for employment, you’ll want to read this terrible tale.

And FYI — Surprise! Once again, Zelle features heavily in an expensive consumer disaster.

A successful job hunt — or a successful hunt for a scam victim?

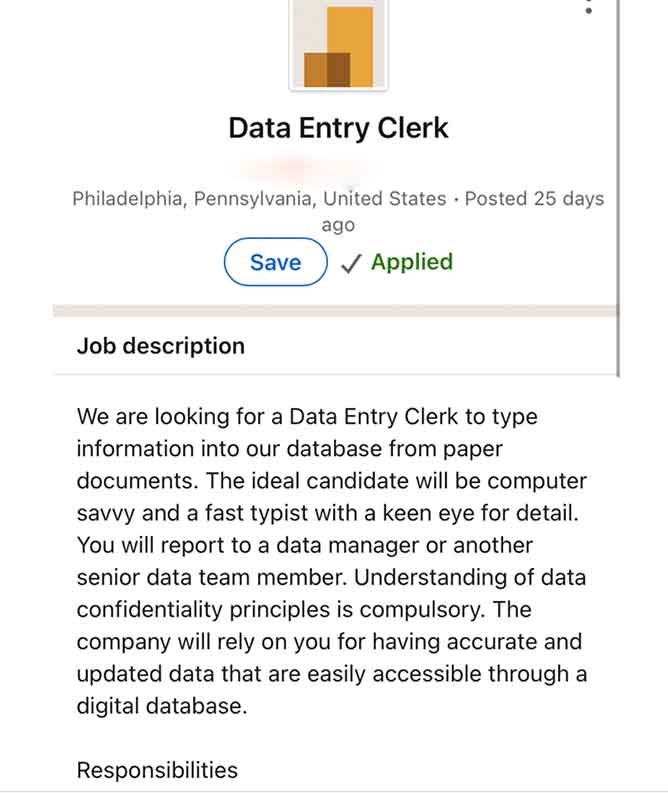

Last month, Erin was on the hunt for a job. She started scrolling the employment listings on LinkedIn.

“I saw a data-entry position that caught my eye, and I sent an inquiry to the contact,” Erin recalled. “Very quickly, a representative of the company sent me an application.”

Erin filled out the document, which asked for various personal details, and sent it right back. From there, the hiring process started moving at lightning speed. Almost immediately, “Mark Miller” of “Miller Associates” responded via text. He said everything looked perfect with her application. And to Erin’s utter surprise, she appeared to have secured a job just hours after her search began.

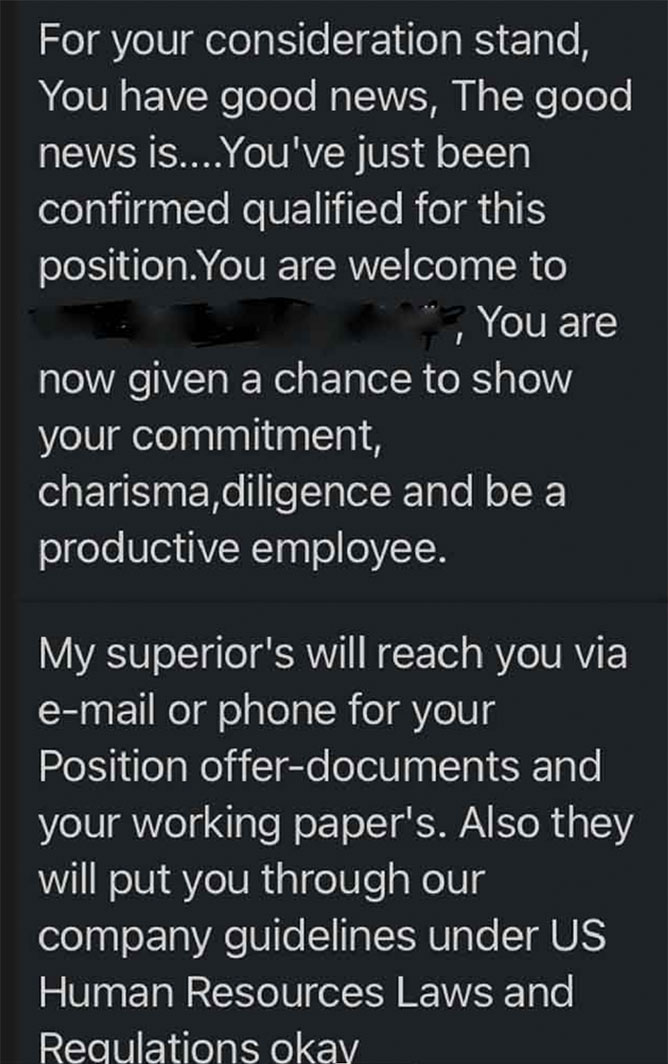

The good news arrived in a text.

Red flag: a job interview via text

The text ended by asking Erin if she was ready for her “job briefing.”

Erin told her new employer that she was indeed ready for her job briefing and was eager to get started. This part of the employment process would also be conducted entirely through text.

“I thought it was a bit odd that he only wanted to interview me for the job via text,” Erin explained. “But everything else seemed legitimate — his LinkedIn profile, photo, the company details.”

So she continued to chat with the friendly business owner. As Mark described the remote position, which paid $20 an hour, with “full benefits, bonuses and paid vacation,” Erin became more and more impressed with her luck at snagging this job. It sounded too good to be true.

And, of course, it was too good to be true, but Erin didn’t know it yet.

A con game: deposit this check and purchase your own job supplies

In her excitement, Erin glossed over the last part of the poorly worded text message. Only after it was too late would she realize that the job description contained giant warning signs that a scam was underway. But caught up in the moment, Erin thanked Miller profusely for the opportunity and looked forward to receiving further instructions.

And those unusual instructions soon arrived.

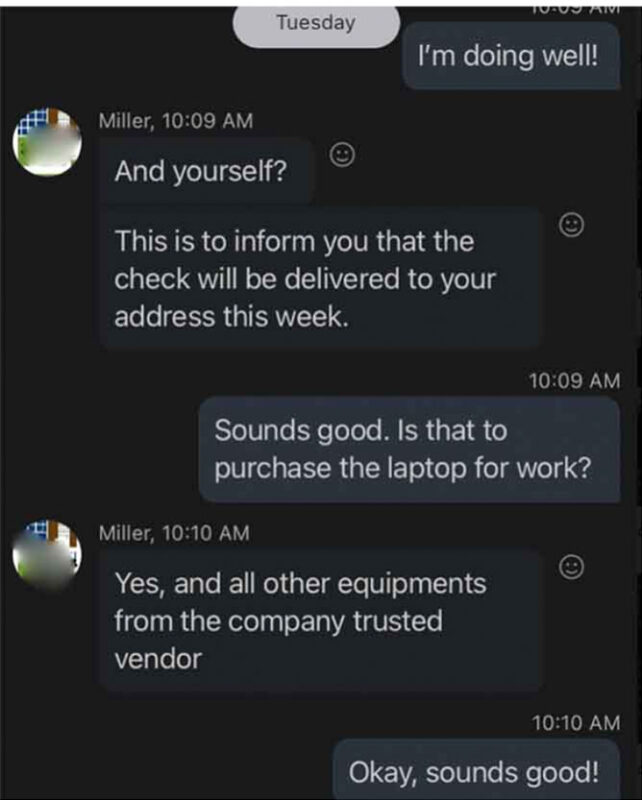

More odd text messages about this new “job.”

Later that same day, Erin received more text messages from the scammers she believed to be her new employers.

Mark explained that the company wanted to get her home office set up as soon as possible. He said that Miller Associates would, of course, pay for all the necessary equipment. But there was a small problem. Because of COVID-19, they would need to send Erin a check for all of the office supplies. She would then deposit it into her account and purchase the items on her own.

Miller went on to say that she couldn’t purchase the items from any particular store. Erin was required to buy the supplies from specific company-approved vendors.

The following day, Erin awoke to a text message from Miller. The nearly $9,000 check was on its way to her home.

The scam was well underway.

Here’s the fake job scam in three easy steps

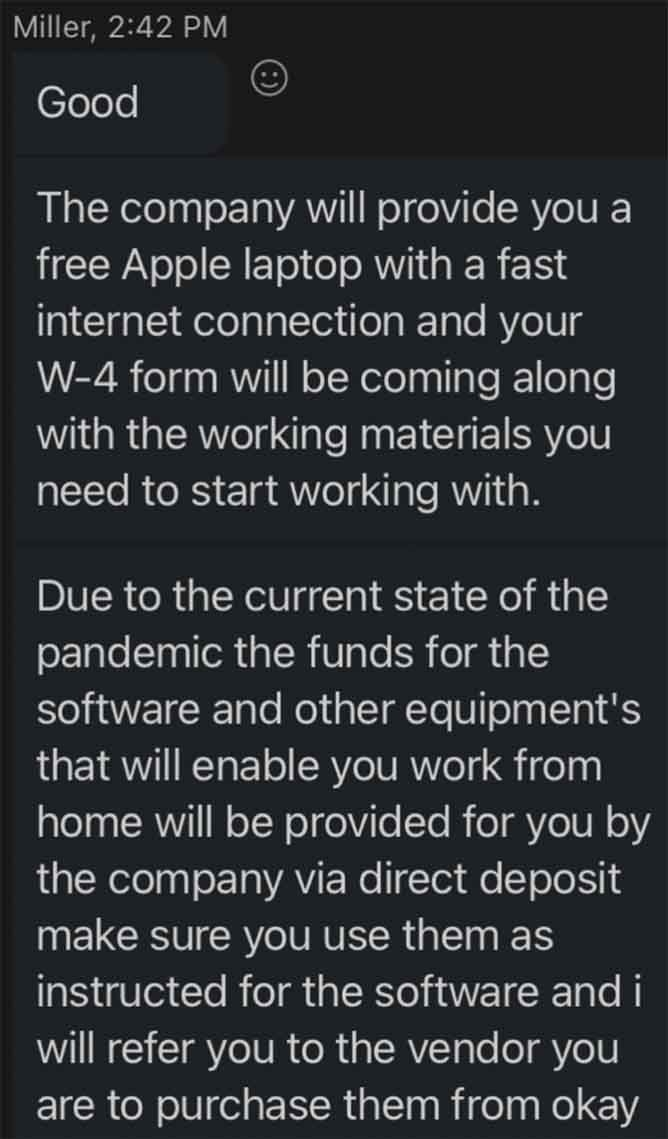

Sure enough, in a few days, the check arrived at Erin’s home, and she quickly let Miller know. He was pleased and explained to her how she would go about purchasing the equipment.

- Deposit the check and wait for the bank to make the funds available.

- Download Zelle and Cash App.

- As soon as the money becomes available, send an instant transfer to each approved vendor via those cash apps.

- Repeat until you’ve spent all the money.

Step 5, which he definitely didn’t mention, was that he would vanish as fast as he appeared. Of course, Erin’s money would disappear with him.

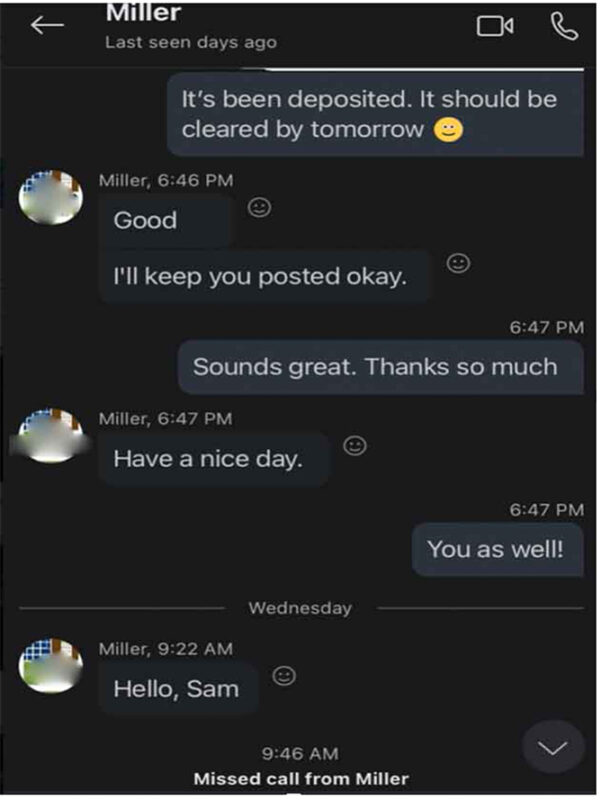

The bank makes the funds available, and the scammer pounces.

Early the following day, Miller started messaging Erin to ask her to check her bank account balance.

Side note: This persistent, urgent behavior is a hallmark of any scam. Predators rely on being able to complete their con game before you catch on.

“Has your bank made the funds available to you yet? ” Miller eagerly asked.

Erin checked her bank account and found that Chase had made the funds available for her use.

Fact: Banks will release funds to good customers before a check clears

Additional side note: It’s important to point out here that if you’re a good customer, your bank assumes that any check you deposit is valid. As a courtesy, it will typically release the funds as soon as possible — usually within 24 hours. But that doesn’t mean that the check has cleared. And if it doesn’t clear, you will be on the hook for the value of the check.

Hearing that Chase had released all of the funds for Erin’s use was music to Miller’s ears.

Soon he was giving Erin a dizzying array of instructions and places to instantly send all the cash. He intended to drain the money as fast as possible.

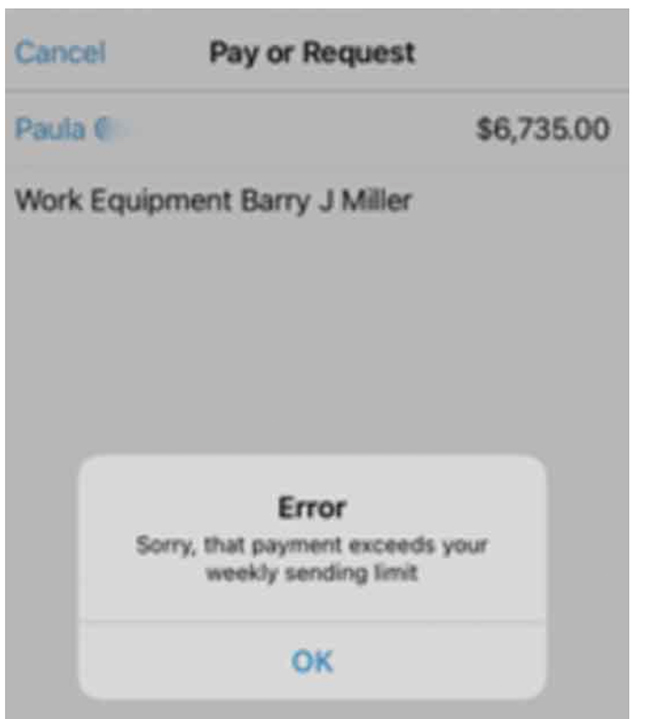

“Send $6,735 to Paula ***** and note that it is for work equipment,” he instructed her. “Then send the rest to Tiffany *****. Do it through Zelle and send me a screenshot immediately afterward.”

Erin explained that she didn’t use Zelle and asked if she could use Venmo. He then gave her instructions about how to sign up for Zelle, his preferred payment method. Erin complied.

“At that point, I just wanted to get the supplies purchased and start my job,” Erin recalled. “I feel foolish now. I didn’t take the time to think it all through.”

Why scammers love Zelle and other cash apps: instant satisfaction

Of course, if you’re a regular reader of my column, you know why scammers love cash apps, especially Zelle: instant satisfaction. Zelle transactions are bank-to-bank transfers — functioning almost exactly like a wire transfer. Once you’ve sent a Zelle payment, you’re not getting your money back. Zelle will not reverse the transaction. Scammers find this feature perfect for their schemes.

Cash apps are a dream come true for scammers. If a predator can convince their victim to transfer a giant lump of cash to them via a cash app, there’s no pesky wait time for the scam to be complete. These instant money transfer services can propel the entire scam process from start to finish at warp speed.

And unfortunately, many consumers who have connected a cash app to their bank account have not read the terms and conditions of the service. As a result, misuse of these services is rampant, with many consumers placing themselves and their cash in precarious situations.

Scammers take full advantage of this mass confusion among users.

Chase puts the brakes on this fake job scam

But then this scammer hit a roadblock. When Erin tried to send the bulk of the money — nearly $7,000 — to Paula, Chase flagged the transaction and blocked it.

A roadblock in this fake job scam

Now the scammer had a real problem. His scheme depended on Erin sending the cash before the bank detected the check was bad. So when Erin told him that she had a weekly spending limit of $2,000, it put his entire fake job scam in jeopardy. His panic is almost visible in the texts.

“What? Ok, well, send $2,000 right away and send me a screenshot immediately,” Miller pleaded. “I’ll send you additional instructions shortly about how to send the balance.”

Still believing that she was talking to a new employer who had entrusted her with $9,000, Erin assured Miller she would send the money to the vendor as soon as he told her how to do it.

Over the next several days, Miller had Erin successfully send much smaller amounts to the two addresses through Zelle and Venmo. Then when Chase refused to allow Erin to send any more cash app payments through her account that week, Miller had one last idea.

He told her that she could send a wire transfer from her bank account to the Wells Fargo account of one of the vendors.

Unfortunately, she complied with all that Miller asked until she had spent every bit of the value of the bad check.

And then the flurry of texts and instructions from Miller ended … completely.

Permanently.

But the worst was yet to come.

Chase: You’ve overdrawn your bank account by $9,000.

Two days later, as Erin was eagerly waiting for all the supplies to arrive — including her new Apple computer — she received a terrible email.

Chase sent me an alert that my account was overdrawn by nearly $9,000. I was stunned. I figured it must be a mistake. So I called the bank. That’s when they told me the check Mark Miller had sent me was bad. I hung up the phone and started texting him. He never answered. I never knew a fake job scam could be posted on LinkedIn. I thought that platform was safe.

Erin spent the next several days trying to reach Miller, his supervisor “Mr. Meadows,” and the two recipients of the $9,000.

“Those two had active accounts on both Zelle and Venmo,” Erin complained. “It looks like their accounts are still live.”

Assuming that Chase would somehow retrieve her money, Erin made an appointment to speak to an agent, bringing her carefully maintained paper trail.

That’s when she received an even bigger shock.

“Chase told me that if I willingly gave the money to these people, they couldn’t help,” Erin recalled. “Since these thieves didn’t break into my account, I’m out of luck.”

Asking our advocacy team for help

For the past several years, we’ve seen a massive uptick in pleas for help regarding cash app mishaps — especially with Zelle. From cash app mistakes to misuse and scams, we’ve seen it all. There is no doubt that these apps are problematic. Not a day goes by now that we don’t hear from someone who has lost hundreds and even thousands of dollars through a cash app.

So when Erin’s email landed on my desk, the topic wasn’t a shock. But what was a shock was the number of layers to this scam.

The scheme had somehow infiltrated LinkedIn, and that fact alone lulled Erin into a false sense of security. The LinkedIn profiles of the men Erin spoke to did look legitimate, but they have since been taken down. In fact, they appeared to be real LinkedIn profiles that the thieves had copied to conduct their fake job scam.

Of course, I felt terrible for Erin, especially when she told me that the thieves had drained the funds she needed for grad school.

But if a person willingly sends money to a scammer using a cash app or a wire transfer, our consumer advocacy team has no one to contact. We aren’t able to investigate crimes or track down villains.

What we can do is continue to share these cautionary tales in the hopes that they’ll prevent others from falling for the same scam.

In Erin’s request for help, she wished for two things: get her money back and make sure these scammers go to hell.

I was forced to break the news that I couldn’t make either of these things happen.

Unfortunately, unless the FBI and Chase track down the owners of these accounts, I don’t know of any way possible to retrieve your money from this scam. Once you click Send on those apps, the cash is instantly gone. A wire transfer is the same. You’ll want to file a complaint with the FBI Online Crimes Department. They have the resources to investigate this scheme.

I also have no way to ensure these scammers go to hell — a different authority will decide that. I’m very sorry! :(.

Michelle

Erin has filed the report with the FBI, and the investigation is ongoing. She says she’ll be sure to send us an update if these thieves are caught.

What to do if you’ve been the victim of a fake job scam

If you discover you’ve fallen for a fake job scam, call your bank’s fraud department immediately. Depending on how you’ve sent your payment to the thieves, you may be able to stop the transfer if you catch it quickly enough.

You’ll also want to report the crime to:

- Your state’s consumer protection organization

- The FBI’s Internet Crime Complaint Center

- The Federal Trade Commission’s Identity Theft Department

Here are the signs of a fake job scam

Keep in mind that the purpose of the fake job scam is twofold:

- To steal your identity: By asking for unnecessary personal information in the initial application, even if you don’t fall for the second half of the scheme, the scammers have details they can use for other nefarious purposes.

- Steal your cash. Of course, their ultimate goal is to extract as much money from you as they can before you detect their scam.

With that in mind, here are some signs to look for so that you can avoid this scam entirely and quickly reject phony job offers.

- Unsolicited job offers.

You should always view surprise offers of employment that come via text, email, or phone call as a red flag. If you didn’t apply for or inquire about the job, it’s almost certainly a scam. Ignore these overtures. (See: This is how to quickly lose $1,100 to the Walmart shopping scam.) - The potential employer asks for unnecessary personal details.

These thieves don’t just want to steal your cash but also your identity. The first step in the fake job scam “hiring” process is requesting lots of your personal details. Be aware; if your potential employer asks for your bank account and social security number, you’re likely in the hands of a scammer. - The potential employer does not have a firm grasp of the English language.

Many job scams originate in a foreign country where English is not the primary language. If you’re applying for a job that’s based in the United States, then a reasonable expectation is that the person who conducts your interview will speak English fluently. Watch for unusual grammatical errors or phrases not common in the English language. And, of course, it should go without saying that if no one from the company is willing to speak to you in person, on a video call, or over the phone, you should assume it’s a scam. - The hiring process is unusually accelerated.

A key characteristic of scammers — including ones specializing in the fake employment offers con game — is that they depend on keeping their prey unaware. This requires that they conduct their scam as quickly as possible, lest their victim becomes wise to their scheme. If the hiring process seems unusually accelerated, slow down and ask questions. Do some research about the company. The “boss” of a fake job will resist your attempts to thwart his scam. A genuine employer will welcome your efforts to make an informed decision about your new potential career. - Your new employer wants you to deposit a giant check into your bank account.

You can be confident that you’re immersed in a fake job scam if your new company asks you to deposit a giant check into your bank account. Often this will be under the guise that you need to purchase supplies or other items related to your employment. There is no legitimate reason that the pandemic would make this type of check shenanigans necessary. If you need supplies for your new job, the company should provide them. - You need to buy your own supplies from specific vendors using Zelle or another cash app.

Cash apps have replaced wire transfers as the payment method of choice of criminals (See: A pet scam cost this victim $4,000. Could you fall for it?) For the fake job scam to be complete, you’ll be required to purchase your supplies from a specific vendor with one of those cash apps. Remember, cash apps are not meant to buy products. They’re intended to send money to friends and family. So if your new employer asks you to get involved in this type of cash app nonsense, you can be sure that you’re dealing with a thief and that your new job is nothing more than a scam. You can safely tell your new “boss” to take that job and shove it! (Michelle Couch-Friedman, Consumer Rescue)

Before you go: Just like the rest of us, criminals also like gift cards… here’s how to avoid common eBay gift card scams.