After Robbin Yeh’s last car rental, Alamo surprised him with a repair bill for mechanical damage to the vehicle. Despite Yeh’s protests that the rental car had pre-existing problems, Alamo continued to pursue him for $662 to fix it. Reluctantly, Yeh agreed to let Alamo file an insurance claim through his credit card company.

At least, that’s what he thought Alamo was doing to pay for the damage to the car.

It wasn’t until four months later that Yeh discovered that he was responsible for filing that insurance claim, not Alamo.

Now with the deadline for filing an insurance claim long since passed, Yeh is asking Consumer Rescue for help. He’s hoping we can convince Chase eClaims to make an exception and pay the repair bill for the rental car.

Can we do it?

Something is wrong with this Alamo rental car

Things started going wrong from the moment Yeh and his family showed up at the Alamo Rent-a-Car counter in Las Vegas last fall.

“I originally booked a minivan for our trip to explore the west,” Yeh explained. “But when we arrived, the [Alamo team] told me that there wasn’t a minivan available for our 10-day rental. Instead, we received an SUV.”

Unhappy with the switch but faced with no other option, Yeh accepted the replacement.

But as soon as they hit the highway in the rental car, a new problem surfaced.

“The entire car was shaking and it was loud,” Yeh recalled. “It didn’t feel right. Every time the car went above 55 miles an hour, it felt very unstable.”

That’s when Yeh made his first mistake with this car rental. Instead of turning the vehicle around and bringing it right back to Alamo, he continued driving it – for three days.

On the third day, I called Alamo and told them the rental car had pre-existing mechanical damage. I wanted to exchange it. By that time, we were in Utah. Alamo told me I could drop it off there and get a new rental car.

Yeh

The family exchanged the rental car and was soon on their way, determined to enjoy the rest of the trip. Yeh didn’t give the vibrating SUV another thought.

That is until a week later when Alamo sent him a bill to repair the vehicle.

Alamo: You need to pay for the damage to this rental car

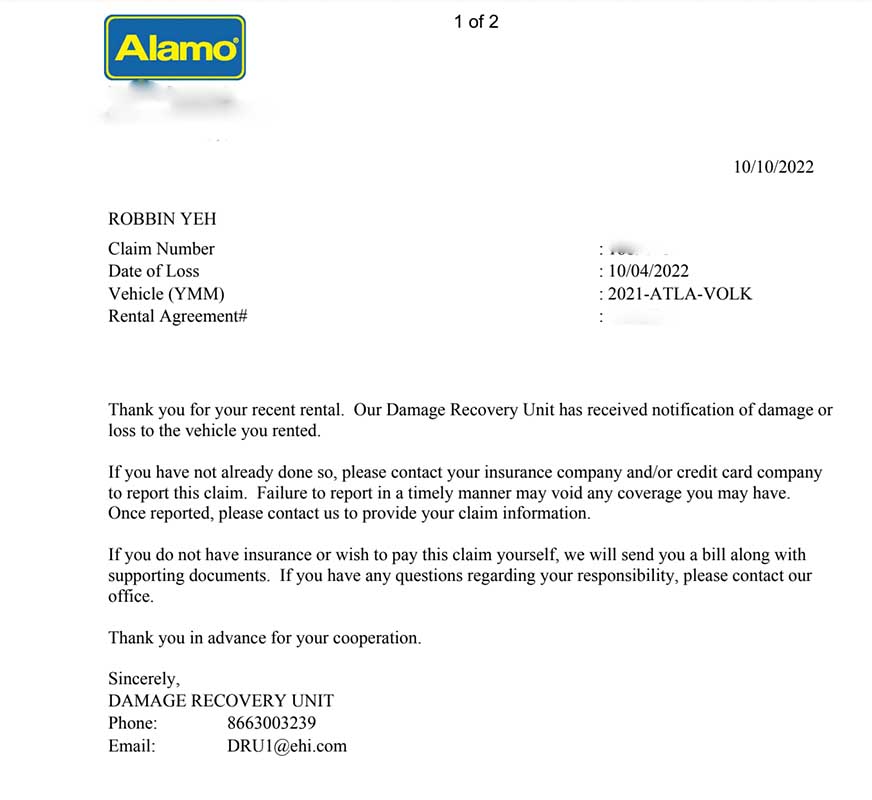

When the family returned from their Western adventure, a letter from Alamo’s Damage Recovery Unit was waiting.

Yeh says he was stunned by the accusation that he had caused mechanical damage to the rental car.

“I thought I was doing the right thing by letting Alamo know about the pre-existing problem,” Yeh told me. “If I hadn’t pointed it out, they would have just passed the car – and the problem – onto the next renter.”

And then Yeh made his next two mistakes with this car rental: He ignored the guidance to contact his insurance or credit card company to file a claim.

Then he disputed the charges.

Will the Fair Credit Billing Act help?

The Fair Credit Billing Act (FCBA) protects credit card users from fraud and billing errors. Unfortunately, consumers often misunderstand and misuse the credit card dispute process. This confusion leads credit card holders to file chargebacks in ways that have little chance of ending in their favor.

Fact: If a car rental company bills you for damage, a credit card dispute is not how to handle the problem. Even if you win the chargeback, the car rental agency can pursue the debt in other ways — including putting you on the Do Not Rent list.

In this case, Yeh had virtually no chance of winning a credit card dispute. Alamo was standing firm that it had provided him with an undamaged rental car. According to Alamo, Yeh returned the vehicle three days later with significant mechanical damage.

Alamo says it submitted a claim

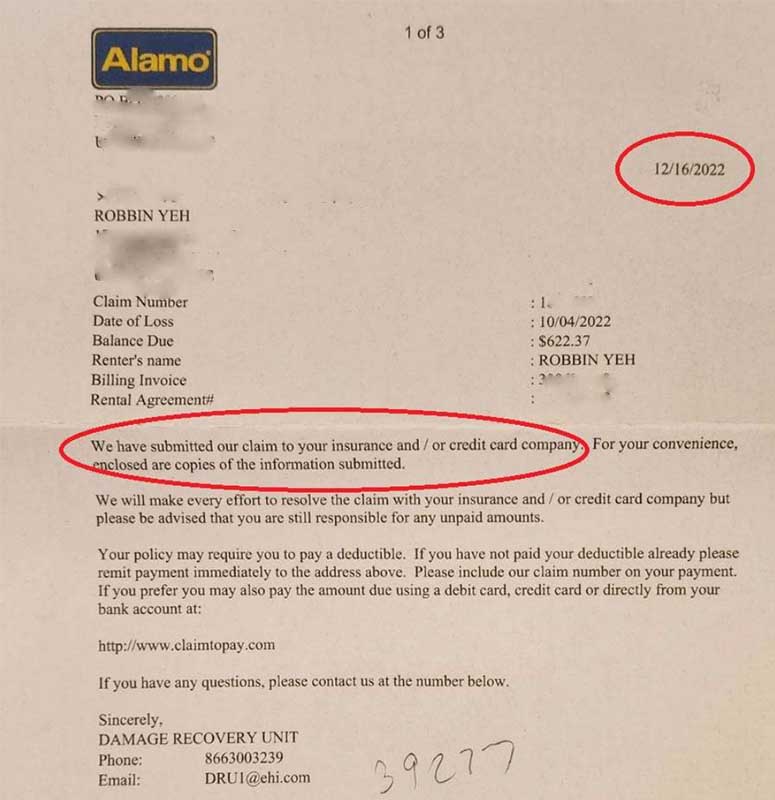

Two months after he was first advised by Alamo to contact his insurance company about the damaged car, the company sent him a confusing and unusual message. The car rental company explained that it had filed a claim for the damage on its own.

Now Yeh assumed he was fully protected from being responsible for paying the $662 repair bill for the rental car.

He wasn’t. But he wouldn’t find out for another two months that Alamo hadn’t filed a claim to pay for the car rental damage at all.

Alamo: “We’re still waiting for you to pay for the rental car damage.”

In February, four months after he returned the vibrating rental car, Yeh found out he was still on the hook for the repair bill.

Not only had he lost the dispute, but he also learned that Alamo had never contacted his credit card’s insurance processor. Worse, he now realized he was beyond the deadline for filing his own insurance claim.

Yeh quickly gathered all the documents needed and contacted Chase eClaims and hoped for the best.

EClaims: “You’ve missed the deadline to file.”

Not long after submitting the damage invoice from Alamo, Yeh received the notification he was dreading: He had missed the deadline to file a claim by several days. His case was rejected.

Not knowing what else to do, but not quite willing to give up, Yeh came across an article I had written about another consumer’s struggle with eClaims and car rental damage.

Yeh had one more idea: to ask Consumer Rescue for help.

I’m so frustrated because I know I didn’t cause the damage to the rental car in the first place. Then, if Alamo hadn’t sent me the letter to say that they were submitting the claim for me, I would have done it during the allowed time frame. I gave the letter to eClaims so that they would see that Alamo told me they were taking care of the claim. Can you help me?

Yeh

Unfortunately, after reading through Yeh’s paper trail and noting the various mistakes he had made with the rental and the subsequent claim, I was doubtful that we could help.

But because of the confusion with Alamo telling Yeh in writing that it was filing the initial claim, I decided to send his case over to our executive at Allianz, the administrator of Chase eClaims.

Asking if eClaims could have one more look at this case

Hi ****,

I have a Chase Reserve Cardholder here, Robbin Yeh, who rented a car last October through the Chase Travel portal with Alamo. He was accused of causing damage to the original car he was given and Alamo told him (in writing) that they were filing an insurance claim through his credit card. But it looks like that never happened because 4 months later they asked Robbin to file the claim with eClaims. By then, it was too late and eClaims rejected his case.

I was wondering if there can be any flexibility on the time limits for filing in this case given the fact that Alamo sent him a written notification that it was filing the claim? I know that isn’t the correct way for these claims to be filed, but Robbin has never filed one before so he didn’t know.

(By the way, not that it matters, but he says he didn’t cause any damage to the car. It had internal problems when he received it, and that was part of the reason he was just letting Alamo handle the claim.)

Could your team have a look and see if anything can be done for him now? Thank you! 😊

Michelle Couch-Friedman, Consumer advocate

The bad – and then the good news from eClaims

Consumers should know that there really isn’t a lot of flexibility in the administration of a travel insurance policy. The details of your coverage and how to file a claim and qualify for a successful outcome are all outlined in the document.

So when I first heard from our executive contact at Allianz that the eClaims team had reviewed Yeh’s case again – and denied it again, I wasn’t surprised.

But then a few hours later another adjuster had one more look at Yeh’s claim. That person decided that the letter from Alamo did, in fact, inject an extenuating circumstance.

Hi Michelle!

I just wanted to let you know that I got a call from an individual at the Card Benefits Center who took a look at my claim and overturned the denial due to the circumstances. They let me know that they issued payment to Alamo and sent over a confirmation notice stating that the denial was overturned.

Hopefully, this is the end of it, and thank you again for your help!

Robbin Yeh

I’m pleased that we could help, but it’s important to note that this reversal of the denial is quite unusual. Consumers shouldn’t expect the same outcome if they make the mistakes Yeh did.

With that in mind…

Here’s how to make sure you don’t get stuck with a car rental damage bill

Our consumer advocacy team receives a significant number of requests for help from travelers accused of causing rental car damage. What’s clear is that consumers must proactively protect themselves from ending up saddled with those bills.

Here’s what you need to know about avoiding, defending, and paying for car rental damage claims.

Inspect the rental car before you go anywhere

Consumers sometimes tell me that they feel silly taking photos and videos of their rental car before accepting it. Don’t worry about the stares from the employees or fellow travelers – you’re protecting yourself. It’s very important to document the visual condition of the vehicle before you drive away. Remember, your smartphone will timestamp your photos and prove how the car appeared when you took possession of it. That information will be invaluable should an unscrupulous car rental location target you for a shakedown.

Don’t forget to give the car a smell test as well. If you detect any unusual odors in the vehicle, do not accept it without documenting the problem (in writing). Preferably, ask for an alternative car.

Take employee names

If you find there is a problem with the rental car you’re about to drive away in, make sure that you alert the agency’s employees. You’ll want to document the issue and take note of the staff member who helped you.

Return the rental car ASAP if there is a mechanical issue

Keep in mind that when you leave the rental car lot, you are taking full responsibility for the vehicle. Any problems that pop up after you drive away are typically yours to correct (and pay for). Review your contract and you will understand the full implications of your signature at the bottom of the car rental agreement.

Of course, mechanical problems are usually impossible to detect beforehand. But if you discover any internal issues with the vehicle, you should hit reverse (figuratively, not literally 🙂) and return to the rental location immediately. Remember, the sooner you alert the rental car agency of the problem, the better the chance you’ll have of avoiding a damage claim.

Make sure you understand your car rental insurance protection

Yeh didn’t understand how to properly use the insurance provided by his Chase Sapphire Reserve card. It’s essential that every traveler understand the insurance protection they’re using.

Alamo wasn’t responsible for filing the claim in this situation, even though the Damage department said it was doing so. Yeh should have promptly filed a report with Chase eClaims as Alamo initially recommended. That can easily be done in one of two ways.

- Call eClaims at 888-675-1461.

- Go to eClaimsline and fill out the form.

Note: Alamo would only have been responsible for processing the claim if Yeh had purchased insurance directly from the car rental company.

Monitor your insurance claim portal

Many consumers are under the impression that if an insurance company accepts their claim, it’s approved. That isn’t true. Most customer service agents will accept your complaint. You will need to provide additional information to the insurance adjuster who actually has the ability to approve your claim.

The requests for additional information will be found in your insurance company’s portal.

Be aware of the deadlines

All insurance companies have deadlines for filing a claim. Always make certain you’re aware of those parameters. And don’t assume a claim has been processed or approved unless you’ve received written notification. Otherwise, you just might end up getting stuck paying the bill — an unpleasant outcome that’s easily avoidable.

If you’ve followed our guidance and still find yourself in a battle with a car rental agency, never fear! Just hit the Consumer Rescue help button. We’ll be happy to investigate and assist you as well — always free of charge. (Michelle Couch-Friedman, Consumer Rescue)